Polestar (NASDAQ:PSNY) investors found a whole new reason to get behind the electric vehicle stock, and they took it. Polestar shares are up modestly in Wednesday afternoon’s trading thanks to reports that it’s got two new SUVs coming to the market soon that will hopefully let it get sales back on track and face down the gas-powered giants dominating the market right now.

Polestar did manage to sell 54,000 vehicles last year, and though that’s not bad—it’s one of the highest figures generated by a “pure-play EV maker” in the field—it still wasn’t good. Polestar looked to sell 60,000 vehicles, so even its own sales guidance proved faulty. But hopefully, the two new models will help spark new sales.

The first is the Polestar 3, which will receive a tax cut that drops the price from its original $83,900 to just $73,400. That puts it in line for federal tax credits and helps with its plan to open a plant in South Carolina this year. The second, the Polestar 4, is a smaller version with a “sporty” theme that might do better for drawing single drivers.

Price and Reliability Troubles

While the new Polestars will be welcome, there are larger problems afoot here. The first is the issue of the price tag; a car that sells for a really good down payment on a house isn’t likely to draw a lot of attention in a market where people are having a hard time buying groceries. Worse, there are reliability issues at hand; electric vehicles, notes Consumer Reports, have 79% more reliability problems than gas powered vehicles.

Buying a huge new repair bill isn’t high on anyone’s car shopping list, and Polestar will have to overcome big objections to get buyers in the door. Throw in brake system problems on Polestars in China, and the problem only worsens.

Is PSNY a Good Stock to Buy?

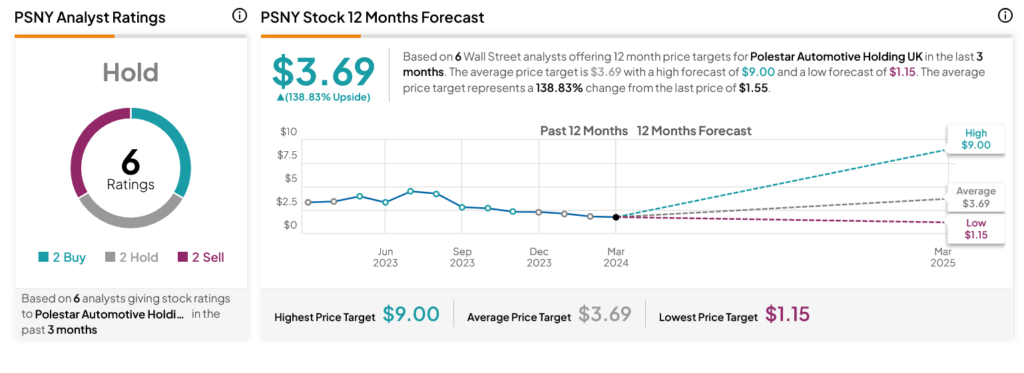

Turning to Wall Street, analysts have a Hold consensus rating on PSNY stock based on two Buys, two Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 57.79% loss in its share price over the past year, the average PSNY price target of $3.69 per share implies 138.83% upside potential.