New Gold (NGD) stock soared on Monday after the gold mining company announced an acquisition deal with Coeur Mining (CDE). Under the terms of this deal, investors in New Gold will receive 0.4959 shares of Coeur common stock for each share of NGD stock that they own. This represents a value of $8.51 per share and is a 16% premium to the stock’s closing price on Friday. The deal represents a roughly $7 billion offer for New Gold.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

New Gold and Coeur Mining expect the acquisition to close in the first quarter of 2026. When it does, the combined company will be owned 38% by NGD investors and 62% by CDE investors. The deal needs the approval of New Gold investors before it can be completed. The company’s directors and senior officers have entered into an agreement to vote in favor of the deal. Once complete, Coeur Mining will expand its Board of Directors and leadership team to include New Gold directors and executives.

Patrick Godin, President, CEO, and Director of New Gold, said, “A combination with Coeur unlocks the next level of potential for our shareholders, uniting with a company of similar financial strength and cash flow generation while also gaining exposure to a larger scale, diversified portfolio with new long-life assets and immense exploration potential. Together, we will be a cash flow powerhouse, leaping above larger peers, with significant exploration upside and the potential to significantly extend mine life and grow net asset value per share.”

New Gold Stock Movement Today

New Gold stock was up 8.86% in pre-market trading on Monday, following a slight dip on Friday. The shares have also rallied 195.97% year-to-date and 165.94% over the past 12 months.

Is New Gold Stock a Buy, Sell, or Hold?

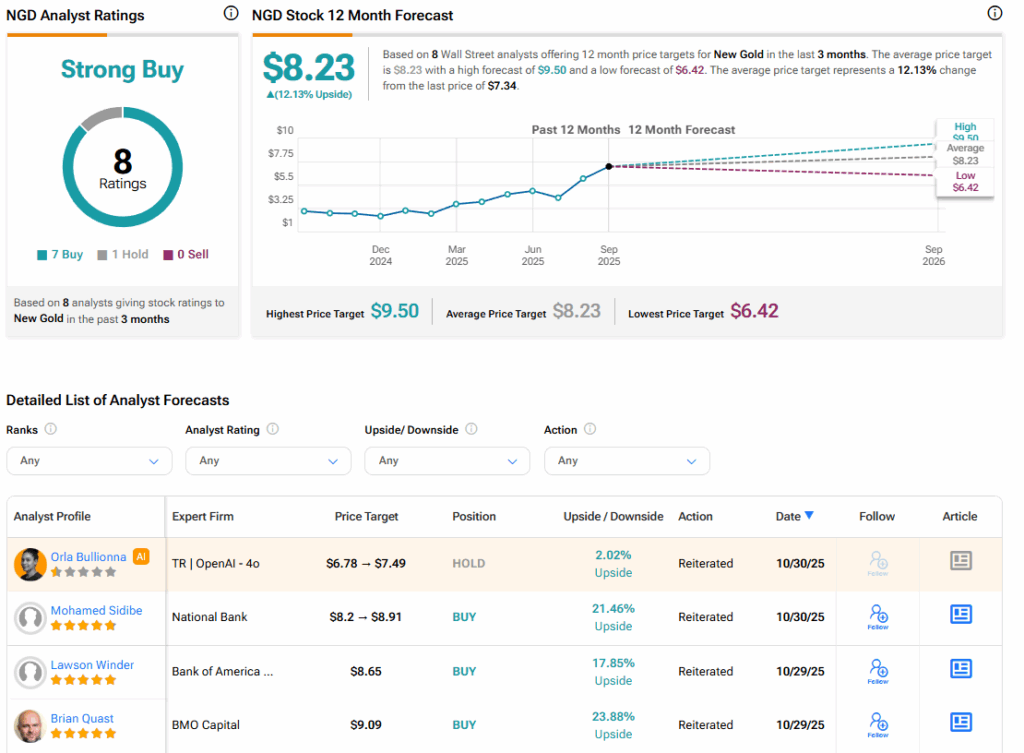

Turning to Wall Street, the analysts’ consensus rating for New Gold is Strong Buy, based on seven Buy and one Hold rating over the past three months. With that comes an average NGD stock price target of $8.23, representing a potential 12.13% upside for the shares.