With the latest Bitcoin halving approaching, looking to Bitcoin miners would make some sense right now. Canadian Bitcoin miner Bitfarms (TSE:BITF) has been rapidly adding capacity ahead of the shift. But that didn’t help it much with investors, who sent shares down over 3% in Friday morning’s trading.

Recently, Bitfarms crossed a critical threshold: it reached a hashrate of seven exahash per second, which is somewhere around one quintillion hashes. That is quite a bit of hash, though these days, it takes around 487.62 exahashes per second to mine one Bitcoin. But Bitfarms is in a better position to mine that Bitcoin thanks to its recent upgrades.

In fact, it currently holds 806 Bitcoin in its treasury, which adds up to about $57 million in total value. Bitfarms recently rounded out its capacity by putting in 3,168 T21s in Garlock and added 1,710 T21s and 100 M35S+ hydro miners to its facility at Farnham. Throughout the second quarter, it will bring in a total of 30,000 T21s that have yet to be delivered.

But Why Isn’t It Helping?

Considering the impressive rise that Bitcoin has seen lately and the fact that it’s not all that likely to decline as more and more institutional buyers get in on the action, you would think that adding to capacity and generating more and more valuable Bitcoin would prove a welcome development. However, this point isn’t lost on Bitfarms’ competition, and several other miners are ramping up their capacity ahead of the upcoming halving.

With so many others getting in on the action, even the measures Bitfarms has taken so far to stay ahead of the pack may not be sufficient, and investors may be concerned about a single-source revenue operation, which is basically what mining Bitcoin is. Any downturn in Bitcoin prices will likely take Bitfarms down with it.

Is Bitfarms a Good Stock to Buy?

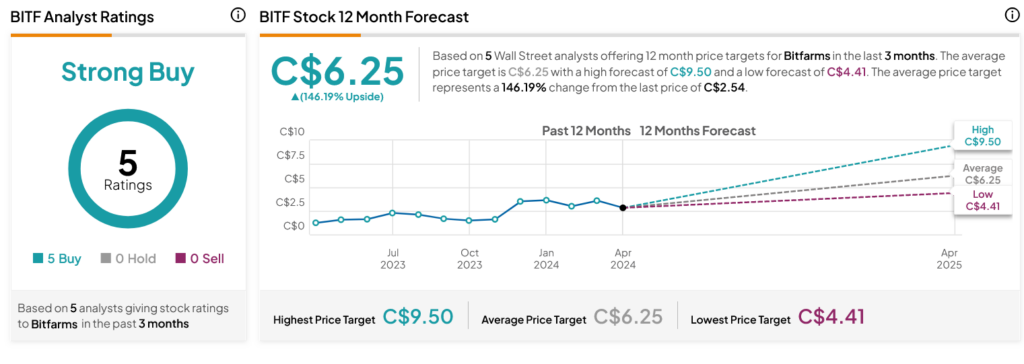

Turning to Wall Street, analysts have a Strong Buy consensus rating on BITF stock based on five Buys assigned in the past three months, as indicated by the graphic below. After a 52.69% rally in its share price over the past year, the average BITF price target of C$6.25 per share implies 146.19% upside potential.