Elon Musk amplified a conservative call to cancel Netflix (NFLX), replying “Same” to a post about dropping the service. He followed with “Cancel Netflix for the health of your kids,” citing objections to the animated series Dead End Paranormal Park. The creator’s private X account limited independent verification of circulating screenshots, but the momentum of the boycott push was clear on the platform.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Musk’s reach can shape consumer narratives even without direct evidence tests in hand. That dynamic introduces headline risk for subscriber sentiment at a time when the stock has been a relative winner.

Netflix Shares Slip While Broader Tape Holds

Netflix fell 0.8% pre-market to $1,162 after a 2.3% drop the prior session. Index futures were modestly higher, which puts the move squarely on the controversy rather than the macro tape. The stock is still up 27% since mid May when it was flagged as a defensive pick that could outrun choppier markets.

Investors will watch for any early reads on churn or downticks in app-store rankings. Even small perception shifts can matter when expectations for steady net adds are embedded in the story.

History Offers Cautionary Tales

Consumer brands have stumbled under boycott pressure before. Bud Light sales cratered in 2023 after a polarizing promotion. Target shares fell roughly 17% in nine days during a Pride-month backlash that same year. Those episodes show how fast sentiment can shift when cultural flashpoints collide with retail brands.

Streaming is subscription based, which gives management levers through programming, pricing, and bundles. It also means cancellation messages can translate into next-month numbers instead of next-quarter orders.

What to Look Out For Next

Track Netflix’s public response and any guidance on churn. Look for third-party data on download ranks, search trends, and top-10 engagement. Watch whether this debate fades as quickly as it flared or whether it persists through the next slate of releases and into earnings commentary.

Is Netflix a Good Stock to Buy Now?

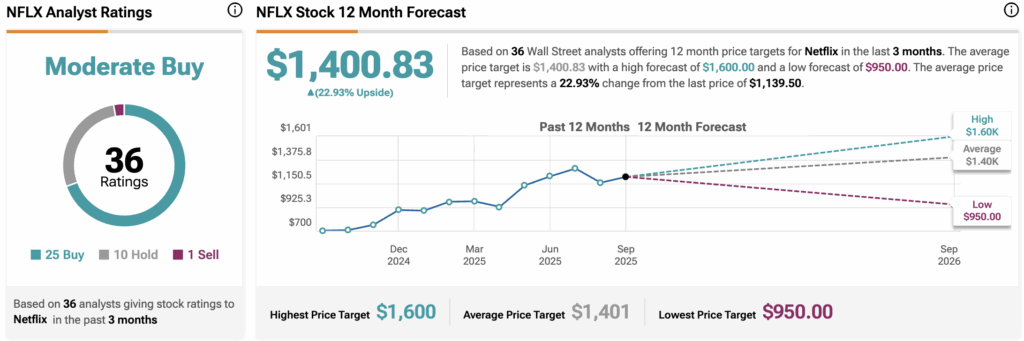

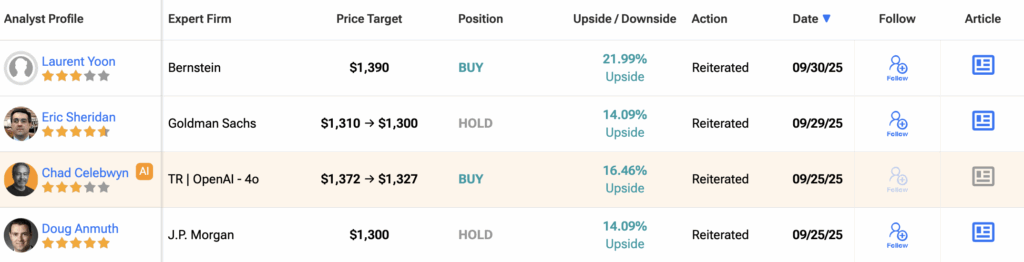

Wall Street sentiment toward Netflix remains cautiously positive. Out of 36 analysts who issued ratings in the past three months, 25 recommend a Buy, 10 suggest a Hold, and just one advises to Sell. That consensus gives Netflix a “Moderate Buy” rating.

The average 12-month NFLX price target stands at $1,400.83, implying nearly 23% upside from the current price.