Netflix (NFLX) has seen its shares surge 42% so far this year, on top of an 83% gain in 2024—giving a total rally of about 160% since early 2024. With its second-quarter earnings report on deck, investors face a crucial question: does Netflix still deserve its rich valuation, or is it time to lock in gains?

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Netflix Doubles Down with Ads to Fuel Growth

Netflix is making smart moves to diversify its revenue. Its nascent advertising business is expected to nearly double this year. That may not move the entire needle yet, but this high-margin income stream adds real value for shareholders. Advertising boosts profits without significantly raising costs.

Introducing ads gives Netflix flexibility. It can keep subscription prices reasonable while growing revenue. That’s a big shift in strategy, particularly as it taps into a new audience segment that prefers lower-cost, ad-supported content.

Watch Margins Climb as Operating Efficiency Improves

Netflix isn’t just bringing in more revenue, it’s lowering costs relative to income at the same time. Operating margin rose from 28.1% in Q2 2024 to 31.7% in Q1 this year. Management is even aiming for 33.3% margin in Q2, up from 27% the previous year.

What that means for investors is straightforward: profit per dollar of revenue is expanding. Combining this margin expansion with 12–15% revenue growth means earnings per share (EPS) could be rocketing nearly 40–45%.

Price Hikes Keep Fueling Cash Flow

Netflix has proven it can raise subscription prices without causing massive churn. In fact, its latest price bumps are already showing up in the Q2 financials. Price increases give Netflix a reliable boost that compounds quarter after quarter, strengthening its free cash flow and supporting continued growth investments.

Beyond the core streaming business, Netflix has doubled down on emerging areas like live events and gaming. These moves extend the time users spend on the platform and diversify growth drivers. Netflix’s crackdown on password sharing also recaptures lost revenue, adding another lever for monetization.

NFLX Stock Still Looks Like a Buy Based on Value Drivers

Netflix trades at a forward P/E ratio of about 60, which sounds high. But when you factor in its near–45% EPS growth (on roughly 12–15% revenue growth plus margin expansion), the stock starts to look less expensive. In fact, Netflix could be growing into its valuation.

Basically, investors are paying up for visibility on future earnings growth. The question is whether the company can execute consistently without surprises.

With Greatness Comes Greater Risk

However, with a premium valuation comes heightened expectations. A single earnings report that disappoints could cause volatility. Regulatory pressure around digital ads or streaming rights costs could also tighten margins. Fans of Netflix stock need to understand that while upside is possible, so is a sharper sell-off if growth slows.

Netflix looks like a Hold for investors focused on long-term growth. Its mix of revenue diversification, improving margins, and powerful content keeps it in the playbook, even at a lofty P/E. If you’re already in, Netflix likely deserves to stay there and a dip could become a buying opportunity. If you haven’t pulled the trigger yet, consider waiting for a slight pullback or lower risk entry point before jumping in.

Is Netflix Stock a Buy, Sell, or Hold?

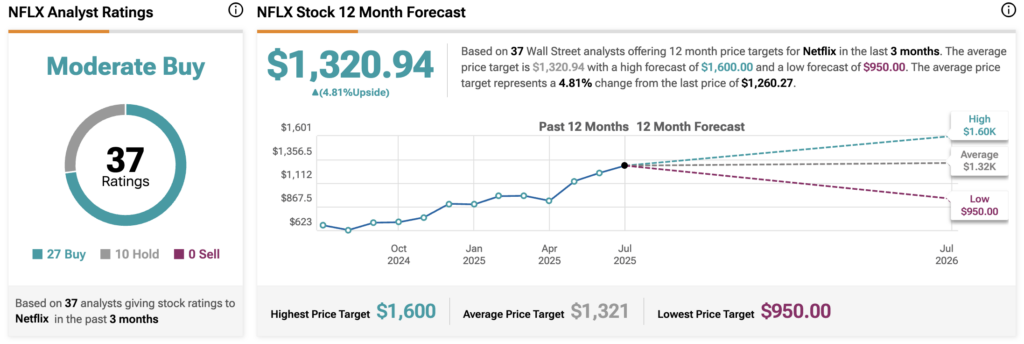

Despite the sharp rally, analysts are not unanimously shouting “Buy.” Netflix stock has been rated a Moderate Buy based on 37 Wall Street analysts weighing in over the past three months. Out of those, 27 analysts issued Buy ratings, 10 said Hold, and none issued a Sell rating.

The average 12-month NFLX price target stands at $1,320.94. That’s just a 4.8% upside from current levels around $1,260.