After reaching all-time highs at the end of June this year, Netflix (NFLX) stock has been trading sideways since reporting Q2 results in mid-July, struggling to reclaim its highs. In my view, this is primarily because the company’s management warned of weaker operating margins in the second half of 2025, albeit for cyclical reasons. Such a caution—while not alarming—doesn’t resonate well in the short term, especially when the stock had been experiencing rapid multiple expansion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

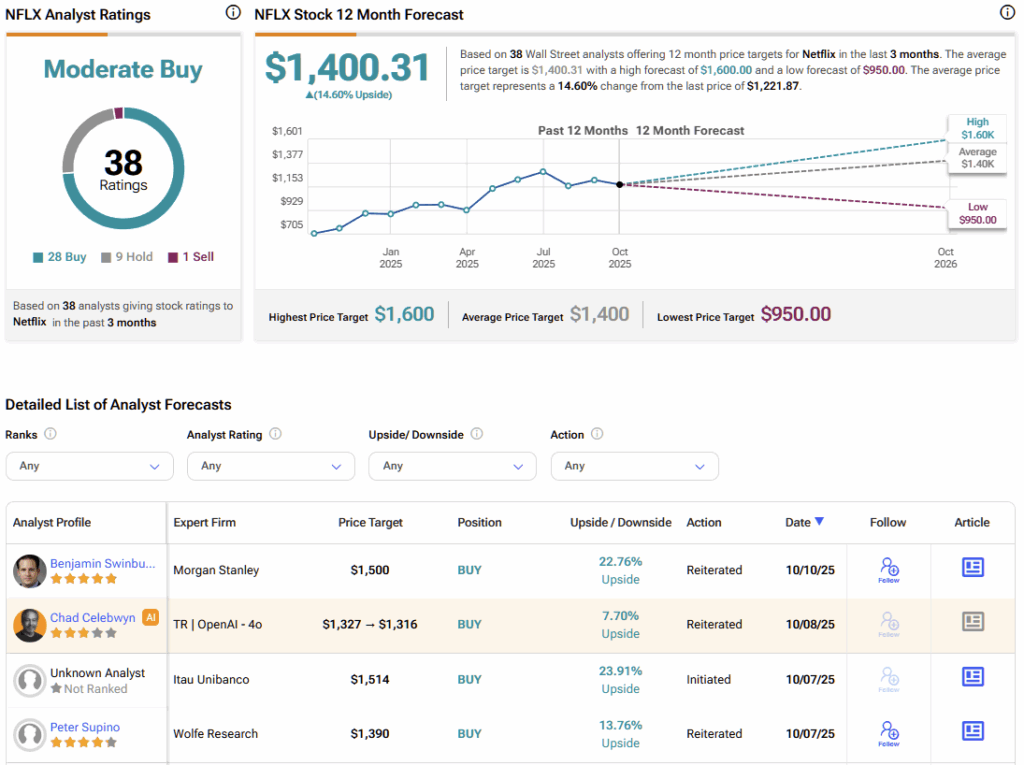

Given this backdrop, even with seemingly stretched valuation multiples, Netflix cannot afford to underdeliver. As the cord-cutting streaming giant prepares to report its results later this month, expectations are running high. I anticipate that the absence of guidance raises could prolong NFLX’s sideways trade.

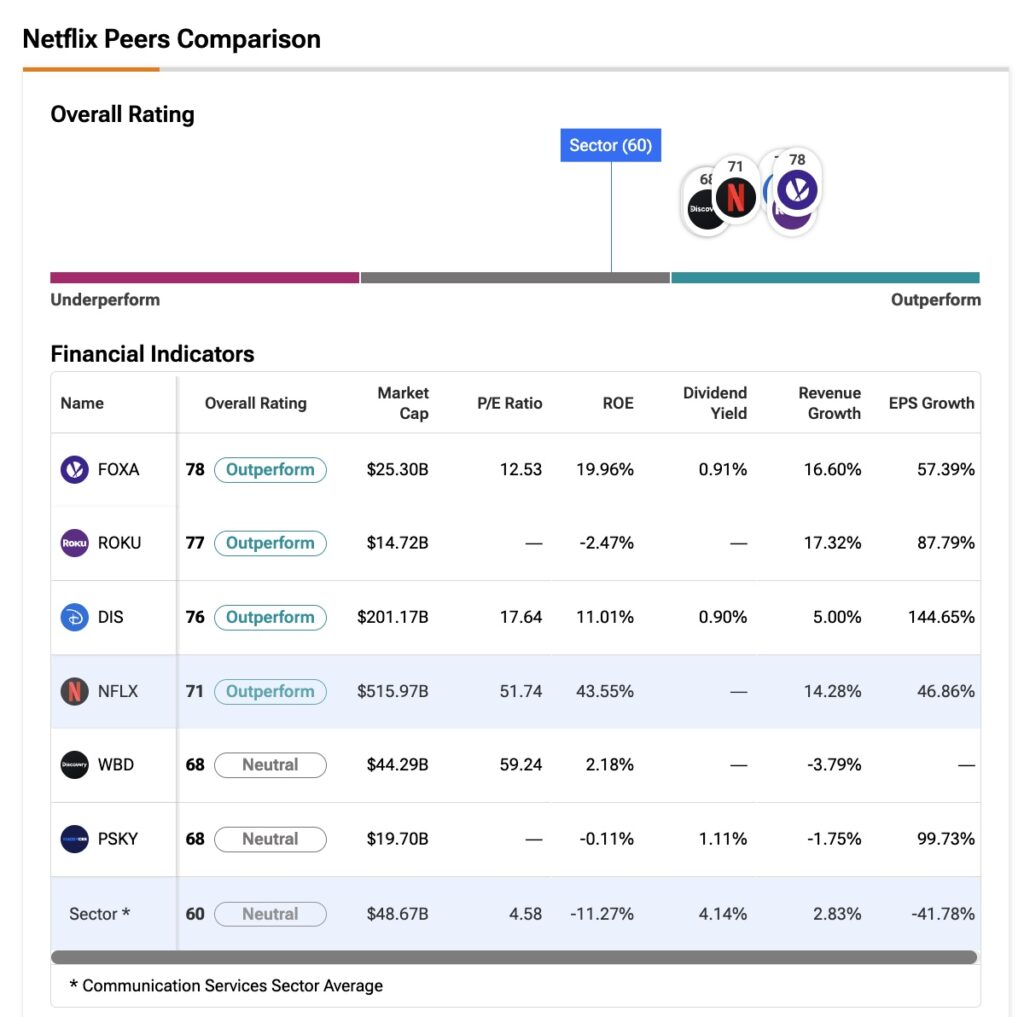

That said, there are strong structural reasons to remain bullish. My Buy rating on NFLX remains firm, thanks to its clear success with the hybrid model, including ad-tier plans offering meaningful growth optionality, and operating leverage at the highest levels in company history. These factors justify a premium multiple and could drive the stock to new highs, especially if the upcoming guidance proves conservative.

How Netflix Turned the Tide

Not long ago, between 2021 and 2022, the market saw Netflix as being in a kind of “limbo.” It was no longer considered a pure growth company, but it wasn’t solid enough to be labeled “value” either, as subscriber growth slowed sharply—turning negative in 2022—and free cash flow struggled to stay positive.

With the streaming market ultra-competitive and Netflix, the undisputed leader, unable to expand its customer base, the company needed to increase its total addressable market. The solution? A hybrid strategy: international expansion, an ad-supported plan, and a crackdown on password sharing. That crackdown, once unpopular, ended up generating millions of new paid subscriptions and stabilizing the global user base.

The ad-supported plan, priced more affordably, not only attracted new subscribers but also created an opportunity to generate additional ARPU. Since 2023, Netflix has realized that giving too much transparency on user counts and regional ARPU has helped competitors calibrate their strategies. As a result, the company now focuses on total revenue, operating margin, and free cash flow instead.

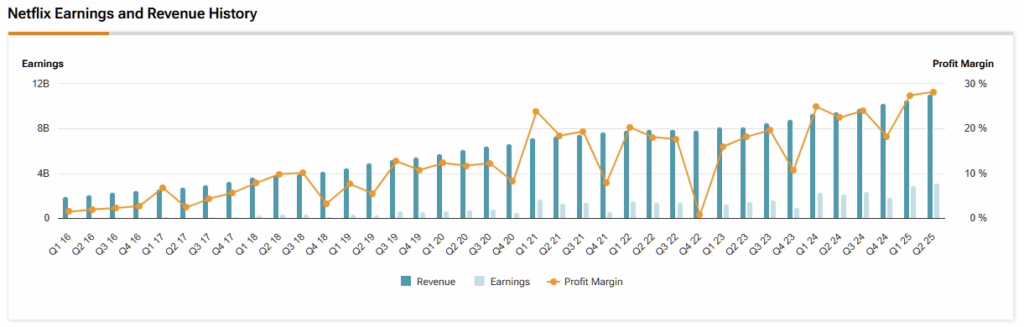

And the results since 2022 have been impressive. Revenue has grown at a CAGR of 10.3% over the last three years, operating income at 27.5%, and free cash flow at 10.7%. From negative free cash flows in 2022, Netflix has accelerated to $8.5 billion today (ttm), qualifying it at least as a value-based business. At the same time, top and bottom-line growth has been faster and better than expected, enough for NFLX to be re-rated as a growth stock again—trading above 40x earnings, a rich multiple typical for a tech growth company.

The Case for Paying Up for Netflix

But the point is that Netflix’s new hybrid strategy has delivered such positive—and rapid—operational results that valuation multiples are now very close to 2018 levels, back when the thesis was all about hyper-growth, still far from full profitability.

Netflix currently trades at 11.6x forward price-to-sales, still below the 14.6x peak it hit in 2018. The difference now is that the company is in a completely different stage. In fact, it now grows earnings faster than revenues.

Investors are effectively paying about 52x earnings for Netflix today, a valuation that implies confidence in the company’s ability to deliver on its projected 15% EPS CAGR and 8.7% revenue CAGR over the next five years.

In my view, that valuation is justified—and more so than it was in 2018. Netflix’s bull case now rests not on speculative growth, but on a demonstrated pattern of profitable expansion, solid margins, and consistent cash generation. That evolution meaningfully reshapes the risk–reward profile.

Moreover, the quality of growth today is higher: EPS is growing faster than revenue, indicating real operational leverage, which arguably deserves a premium. Back in 2018, each additional dollar of revenue came at a high cost, affecting future profit generation. Today, each dollar generated flows much more directly to the bottom line.

What to Expect from Netflix’s Next Earnings

As Netflix approaches the reporting of its September-quarter results, and given that the company is trading at seemingly stretched multiples, it may need to “overdeliver” to maintain momentum.

In the previous quarter, Q2, Netflix told investors it expected revenue growth of 17%, driven primarily by membership growth, pricing strategies, and ad revenue. The market currently expects slightly more—$11.52 billion in Q3, which would imply annual growth of 17.25%. Management also flagged that operating margins could be weaker in the second half of 2025 due to higher content amortization and sales and marketing costs.

With the dollar weakening over the course of the year—already partially factored into Netflix’s annual guidance of $44.8–$45.2 billion, which had been revised upwards—it’s worth noting that a weaker dollar is generally positive for Netflix, since about 60% of revenue comes from outside the U.S. Foreign-currency revenues translate into more U.S. dollars when the dollar loses value, boosting both reported top line and earnings.

Along these lines, I see room for positive surprises in Netflix’s results, potentially including an upward revision of guidance. If Netflix posts a beat across the board in Q3, it would mark its seventh consecutive quarter of analyst-beating performance. To move the needle even more, I believe a guidance raise for 2025 would be essential—and that outcome seems quite possible.

Is NFLX a Buy, Hold, or Sell?

Wall Street consensus on NFLX is currently bullish. Out of 38 analysts covering the stock, 28 are bullish, nine are neutral, and just one is bearish. The average stock price target is a shade over $1,400, which implies a potential upside of 14.6% over the next year.

Earnings Set to Reinforce Growth Thesis

The odds are stacked in Netflix’s favor heading into its September-quarter earnings, and I don’t expect any unexpected developments to structurally shake the bullish thesis. While valuations might look stretched at first glance, I believe they’re well justified given the clear quality of operational leverage Netflix is delivering.

There may be some margin headwinds, but these are likely cyclical and don’t pose any significant threat to the growth story—especially considering the strong value elements embedded in the business. For these reasons, I continue to view NFLX as a Buy for the time being.