We have heard, for some time now, about streaming giant Netflix (NFLX) and its plans to get people more into their properties by making them more than things you watch, but rather, things you do: full-blown experiences that attempt to make a greater connection with the viewer. Netflix Houses and more have advanced over the course of the last year, and now, have received a little more fleshing out. This did not sit well with investors, as shares slid fractionally in the closing minutes of Wednesday’s trading.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

The Netflix House concept apparently will be going live soon, reports noted, as Fall 2025 will see the opening of two such locations: one in Dallas, Texas, and one at the King of Prussia Mall in King of Prussia, Pennsylvania. The locations in question will be in the middle of what used to be retail space, but now, will be host to a series of interactive events, shopping, and more around Netflix properties.

This includes, reports note, everything from a Regency-era costuming drama focused around the Bridgerton series to re-enacting the games from Squid Game. Though, of course, without the huge cash prizes and multiple deaths. Stranger Things will be in full presence, of course, as will newcomer hit Wednesday, along with lesser hits like Knives Out and Big Mouth.

You Needed to Get Out of the House Anyway

In an odd twist, though, Netflix will be encouraging visits to these live-action attractions by removing one key reason to just stay home: pulling some of the platform’s games. Netflix’s gaming operations had been under fire for some time now, closing its primary development studio back in October. And now, the company is removing more than 20 games from the platform altogether starting this July.

From Monument Valley to Ludo King to Hades, Netflix’s gaming presence is about to pull back substantially. The why of their departure is unclear; perhaps Netflix is circling the wagons to address key intellectual property rather than diffusing it among several branches. But given that Netflix already owned the games in question, why not exploit property that is already in place and likely represents comparatively minimal additional costs?

Is Netflix Stock a Good Buy Right Now?

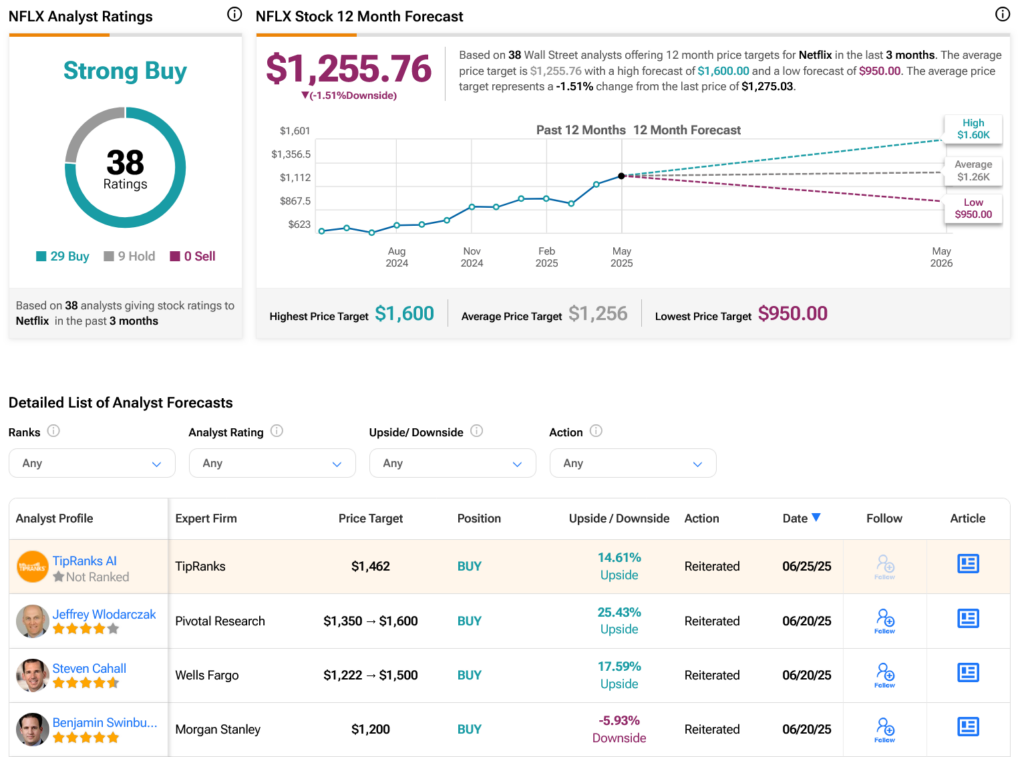

Turning to Wall Street, analysts have a Strong Buy consensus rating on NFLX stock based on 29 Buys and nine Holds assigned in the past three months, as indicated by the graphic below. After a 88.75% rally in its share price over the past year, the average NFLX price target of $1,256 per share implies 1.51% downside risk.