Netflix (NASDAQ:NFLX) reported better-than-anticipated results for the first quarter of 2024. However, shares fell following the earnings report, as investors were not pleased with the company’s decision to stop disclosing its quarterly subscriber numbers effective Q1 2025, as it is more focused on metrics like revenue and operating margin. Despite the 11% sell-off in NFLX stock, several analysts remain upbeat about the streaming giant and expect continued growth.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

It is worth noting that Netflix stock has risen 72% in the past year even after the post-earnings pullback.

Netflix’s Impressive Performance

Netflix started 2024 on a good note, with revenue rising 14.8% to $9.4 billion. Moreover, earnings per share (EPS) jumped to $5.28 from $2.88. The company’s streaming paid memberships increased 16% to 269.6 million.

The Q1 2024 operating margin rose by seven percentage points to 28%. Consequently, Netflix raised its full-year operating margin guidance to 25% from the previous outlook of 24%.

Clearly, Netflix’s strategies are helping deliver the desired results. Mainly, the company’s crackdown on password sharing and the introduction of an ad-supported tier are driving its financials higher.

Analysts’ Reactions

Following the Q1 print, analysts at Bank of America raised the price target for Netflix stock to $700 from $650 and reiterated a Buy rating. They think that the company still has many growth drivers, including an accelerating ramp-up of its rapidly growing ad business, continued (but moderating) benefit from password sharing, and a strong content slate. Additionally, they noted that there is significant scope for further subscriber growth in developing markets.

In reaction to the solid results, Needham analyst Laura Martin upgraded Netflix stock from Hold to Buy with a price target of $700. Martin sees an upside to the company’s revenue growth, driven by its ad revenue and generative artificial intelligence (AI) benefits that tech-first companies like Netflix are expected to witness. The analyst also expects the company to gain from its global scale and price increases.

Meanwhile, Goldman Sachs analyst Eric Sheridan reiterated a Hold rating with a price target of $600. The analyst thinks that the “lessened disclosure” (regarding the quarterly subscriptions) and the possible fading of tailwinds from password initiatives could trigger a key debate among investors.

Is NFLX a Good Stock to Buy?

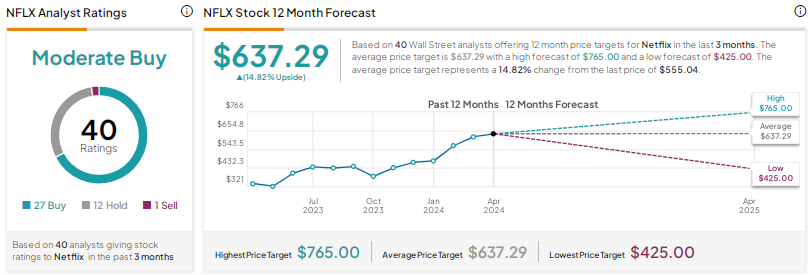

With 27 Buys, 12 Holds, and one Sell, Netflix earns a Moderate Buy consensus rating. The average NFLX stock price target of $637.29 implies nearly 15% upside potential from current levels.

Conclusion

Despite some concerns about a slowdown in paid sharing benefits, several analysts remain bullish on Netflix’s ability to grow further in the streaming space, driven by its ad business, global presence, and strong content.