Shares of streaming giant Netflix (NASDAQ:NFLX) fell in after-hours trading after the company reported earnings for its first quarter of Fiscal Year 2024. Earnings per share came in at $5.28, which beat analysts’ consensus estimate of $4.51 per share. Sales increased by 14.8% year-over-year, with revenue hitting $9.37 billion. This beat analysts’ expectations of $9.28 billion. In addition, global streaming paid memberships increased to 269.6 million users, which equates to a 9.33 million user jump in the first quarter. Meanwhile, analysts had forecast 4.84 million users.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Looking forward, management now expects revenue and adjusted earnings per share for Q2 2024 to be $9.49 billion and $4.68, respectively. For reference, analysts were expecting $9.527 billion in revenue, along with an adjusted EPS of $4.55.

Is NFLX a Buy?

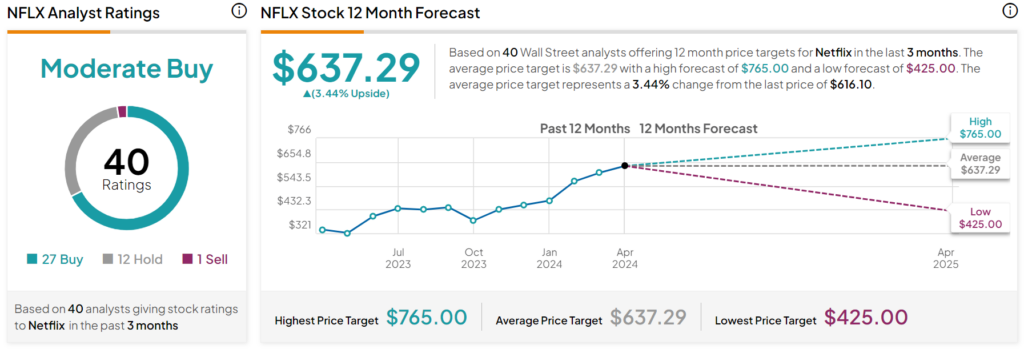

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NFLX stock based on 27 Buys, 12 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 90% rally in its share price over the past year, the average NFLX price target of $637.29 per share implies 3.44% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.