Shares of leading video streamer Netflix (NASDAQ:NFLX) found themselves in correction territory following the release of its solid Q1 earnings, declining more than 9%. This decrease was due to a mild reset in near-term expectations and a bit of added uncertainty regarding the firm’s plans to stop reporting two key growth metrics: average revenue per user (ARPUs) and paid subscribers. Though near-term growth could stall, I still find Netflix stock to be a Buy post-earnings for investors committed to the company’s long-term strategy.

Undoubtedly, investors looked right past the great Q1 numbers to the soft full-year sales guidance and the unexpected news that two fewer metrics will be revealed quarterly. Indeed, it’s not too hard to imagine that Netflix is no longer disclosing such data points because some ugly times are ahead.

No More Subscriber Adds and ARPUs: The End of an Era

The company’s rationale seems to be that subscriber growth and ARPUs aren’t as important as they used to be. Instead, the firm may wish to point investors towards prioritizing other metrics, most notably overall revenue growth and viewing time. In any case, such metrics don’t reveal nearly as much about where growth could be headed over the medium term. Though the lowest-hanging fruit may have been grabbed, I certainly wouldn’t dismiss Netflix’s abilities to re-accelerate its top-line growth over the longer term as it explores new growth levers.

From more interactive (think video games) and immersive (could virtual reality be an exciting new frontier?) content to streaming live sports (Mike Tyson will be taking on Jake Paul this summer, live on Netflix), the streaming king still has plenty of creative ways to drive revenue. That said, it’s going to take some time before the firm can excite us again as some of the more nascent tech comes into its own.

At this juncture, Netflix may be headed down the path of live sports streaming and video gaming. Such areas may help unlock a bit of revenue growth as it seeks to charge more by offering new types of content. However, it’s hard to ignore the explosive growth potential behind the looming rise of the metaverse. Further, given that management seems to see gaming as the main draw of VR, it’s arguable that Netflix has already created a nice onramp for itself, with games available to be played right through the Netflix app, to hop aboard the VR bandwagon.

Dismiss Netflix as “just another video streamer,” if you will, but the firm has demonstrated a willingness to evolve with new technologies that come its way. Most importantly, the company has made the jump into new media (like DVDs to streaming) with exceptional timing.

In light of the potential growth levers, Netflix can pull in over the next several years. I have to stay bullish on NFLX on this dip, even if some nearsighted investors believe they’ll be left in the dark about subscriber growth.

Netflix: The Jump to Spatial Could Be as Significant as Its Jump to Streaming

Netflix may very well be the least exciting (or tech-savvy) member of the FAANG cohort nowadays. While it’s still a market leader, with some of the best new content to keep many from churning the subscription, additional subscriber growth is going to get a lot tougher from here. To bolster growth, Netflix needs to put itself out of its comfort zone to expand into new markets while exploring uncharted territory (think spatial computing) to get users to flock over to its platform.

For the users that have stayed aboard, Netflix needs to find a way to make them pay more by offering more on the “wow” factor. Indeed, it’s been quite a while (more than 12 years) since Netflix wowed us with its technological prowess. In any case, I wouldn’t underestimate Netflix as it considers options with the new, emerging entertainment medium that may just be a decade (or less) away from prime time.

For now, Netflix lacks any clear plans to launch a spatial app on the new Apple (NASDAQ:AAPL) Vision Pro spatial computer (or mixed-reality headset, if you prefer). It doesn’t even have a clear VR or AR strategy quite yet, and it’s unclear when or if it will.

Does that mean Netflix will be left behind as some of its streaming rivals — most notably Disney (NYSE:DIS) — embrace the metaverse (and its like) with open arms in these early stages?

Probably not. Other incredibly popular apps, like Spotify (NASDAQ:SPOT) and YouTube, haven’t yet landed on Vision Pro. But my guess is they will, in due time, once there are enough users to make the development efforts worthwhile. Further, I think it would make more sense for Netflix to launch its spatial app with a bit of spatial content thrown into the mix. In the meantime, Vision Pro users can still access Netflix the old-fashioned way, through the website via the Safari browser.

Though early adopters of Vision Pro may be frustrated by the lack of a native Netflix app, I do see Netflix coming to visionOS at some point in the future, perhaps when the spatial computer starts flying off shelves—something I don’t expect will happen until Apple launches a much cheaper and lighter headset. Recent downward sales projections for Vision Pro have not been encouraging either.

Netflix is Still Years Away From Making the Metaverse Jump

Considering the significant uncertainties and substantial investment needs associated with innovating in the metaverse and similar realms, I wouldn’t criticize Netflix’s managers for refraining from diving headfirst into these uncharted waters just yet. I think it’s safe to say that many investors are put off by excessive metaverse and spatial computing expenditures, with Apple and Meta Platforms (NASDAQ:META) both having spent tens of billions of dollars on their respective mixed-reality projects, with a return that may still be many years away.

Even if Netflix were to launch some VR content, there may not be enough consumers who have the means to enjoy such content. And for those who do, good luck getting them to spend a bit more money on a rather limited slate.

When the right time comes, I have no doubt Netflix will be ready to power its way into spatial. But, like robotaxis and other exciting technologies we can’t wait for, the technology’s parabolic rise to glory may still be a few years (I’d pin it at four to six years) away from generating some serious returns on investment.

For now, it’s up to the platform developers, like Meta and Apple, to bear the most risk and spend the most to bring the masses into the new realm. Then, the spatial content flywheel will finally be able to get spinning, opening up new windows of growth for firms like Netflix.

When this time comes, perhaps Netflix will have reason to start reporting subscriber growth and ARPUs again! Until then, expect Netflix to be a stealth innovator that’s just waiting for the right moment to pounce as it explores new content types to keep people entertained on their 2D screens.

What Is the Forecast for NFLX Stock?

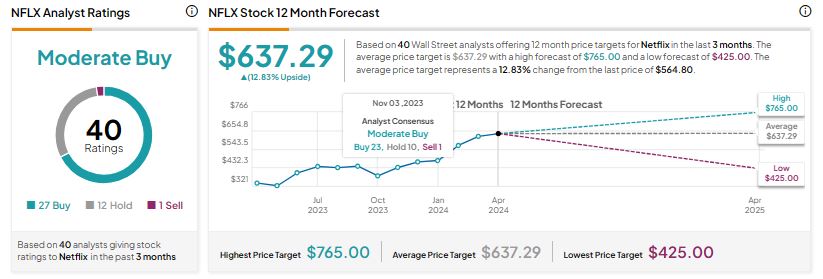

On TipRanks, NFLX stock comes in as a Moderate Buy. Out of 18 analyst ratings, there are 27 Buys, 12 Holds, and one Sell recommendation.

The stock has gained over 92% in one year. Analysts’ average price target on NFLX stock is $637.29, implying upside potential of 12.8%.

The Bottom Line on Netflix

We’ll all feel a little bit less “in the know” without a few quarterly growth-centric metrics reported. That said, I think it’s better for long-term investors to focus on the multi-year growth story than to place too much emphasis on quarter-to-quarter fluctuations. The rise of spatial computing content could be a main focus for those willing to hang onto Netflix stock for the next decade.