Sometimes not even an analyst’s say-so is enough to goose a stock upward. Just ask Netflix (NASDAQ:NFLX), the streaming titan who got some good word in from Baird, but still slipped fractionally in Monday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Baird—by way of analyst Vikram Kesavabhotla—upgraded Netflix to Outperform, noting that the changes that Netflix has made have, so far, been good for the stock. Second quarter earnings suitably impressed, and the moves to offer ad-supported tiers—even at the cost of the Basic tier—complete with new support for advertising have been quite the help. Plus, with Netflix about to come into a “period of particular strength” with fall and winter just around the corner, that should help bolster cash flow. Interestingly, Kesavabhotla doesn’t seem concerned about either macroeconomic issues with potential downturns ahead or the impact of the still-ongoing writer’s strike, now supported by an actor’s strike.

Netflix is also working to make things easier on customers, which will hopefully keep them in the fold. A new tab in its mobile apps—My Netflix—just hit iOS today and will hit Android within the next couple of weeks. My Netflix shows you what you’ve already seen, so that you’re in a better position to find something new. Considering the likely dearth of upcoming shows thanks to the aforementioned strikes, Netflix may have just given customers a reason to stick around in the face of a potentially ongoing lack.

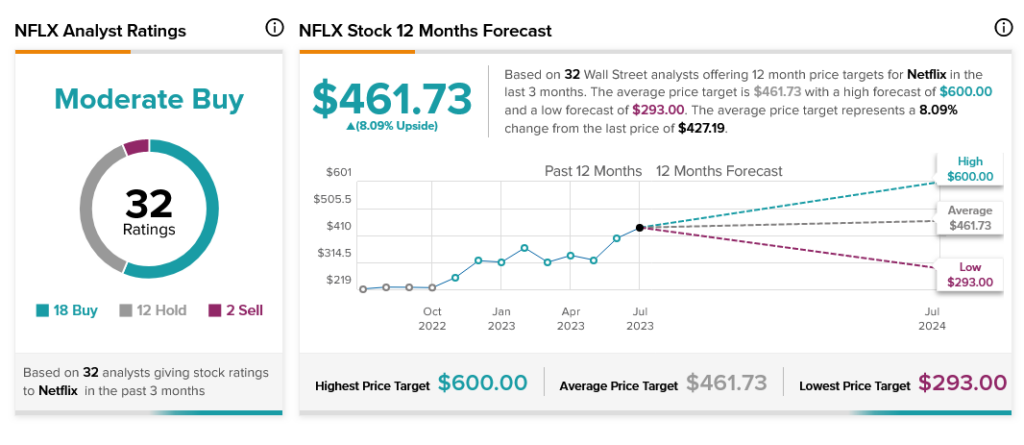

Analysts in general, however, are somewhat more skeptical than Kesavabhotla. With 18 Buy ratings, 12 Hold and two Sell, Netflix stock is considered a Moderate Buy. Further, with an average price target of $461.73, Netflix stock also offers investors an 8.09% upside potential.