Streaming giant Netflix (NFLX) has announced a 10-for-1 stock split.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company said that existing shareholders as of Nov. 10 will receive nine additional shares for each one they hold. The stock will begin trading on a split-adjusted basis Nov. 17. Netflix shares added more than 2% in after-hours trading on news of the stock split. Shares currently trade at $1,125, having gained more than 40% this year.

Netflix is currently one of only 10 stocks in the benchmark S&P 500 index that has a price above $1,000. After the split, the stock would trade at $112.50 based on the current share price. In a news release, Netflix said the stock split is being executed to “reset the market price of the Company’s common stock to a range that will be more accessible to employees who participate in the stock option program.”

Previous Splits

Netflix has split its stock twice before, in 2004 and again in 2015. A split simply gives each holder more shares at a lower price, while the value of their holding does not change. The company’s fundamentals also remain the same. However, a lower share price makes the stock more accessible to investors.

The stock split comes after Netflix reported disappointing third-quarter financial results. Earlier in October, the company announced earnings per share (EPS) of $5.87, which was well below the $6.97 expected among analysts. Revenue of $11.51 billion matched the consensus expectation on Wall Street.

Is NFLX Stock a Buy?

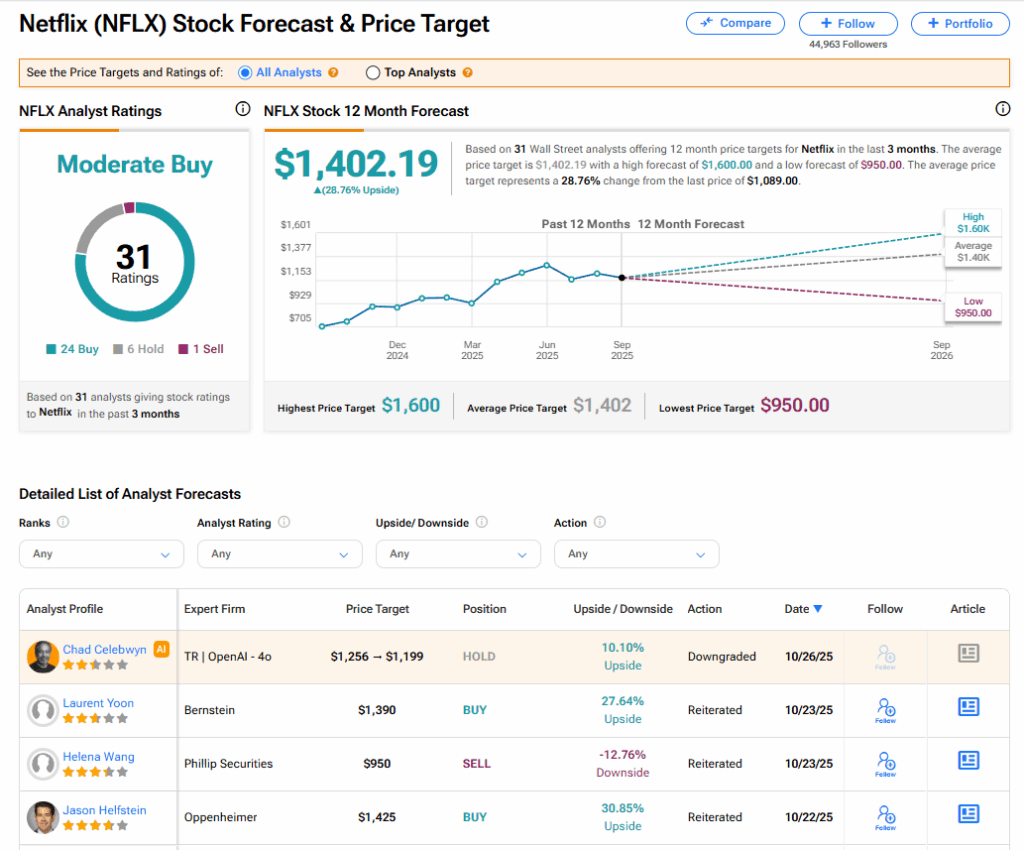

The stock of Netflix has a consensus Moderate Buy rating among 31 Wall Street analysts. That rating is based on 24 Buy, six Hold, and one Sell recommendations issued in the last three months. The average NFLX price target of $1,402.19 implies 28.76% upside from current levels.