Streaming giant Netflix (NASDAQ:NFLX) delivered a strong performance in the first quarter of Fiscal Year 2024. The company’s earnings and revenues surpassed analysts’ expectations by a wide margin and improved year-over-year on robust subscriber growth. Interestingly, Netflix’s upbeat results wouldn’t have come as a shock to users who closely monitored the company’s website traffic, using TipRanks’ Website Traffic Tool.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The tool gathers data on website visits and can offer valuable insights into user demand for a company’s products or services. This information can be used to predict the upcoming earnings report, as growth in online usage may point to higher sales.

Learn how Website Traffic can help you research your favorite stocks.

Website Traffic Showed Growth

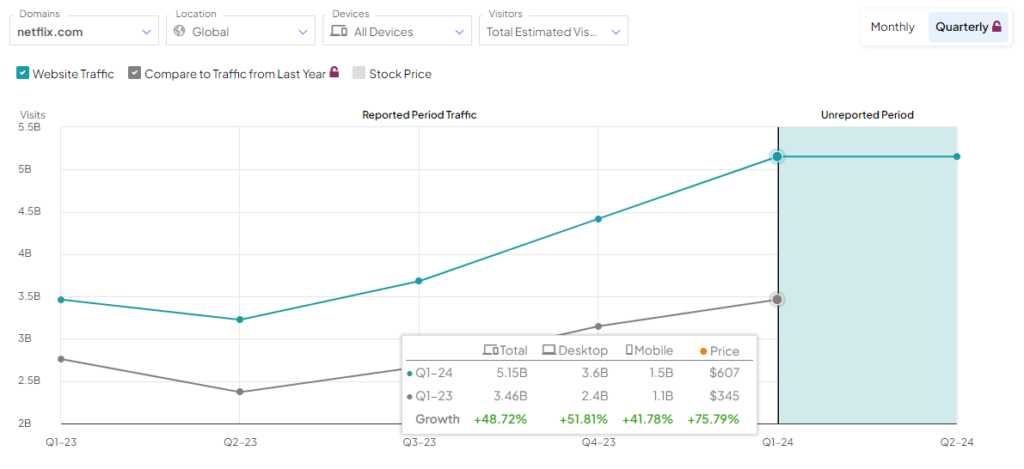

Ahead of the company’s Q1 results, the tool showed that website traffic for netflix.com witnessed a 48.71% year-over-year increase in total estimated visits. Moreover, it was up about 17% sequentially. The surge in website traffic indicated that NFLX could deliver a solid top-line performance.

Eventually, Netflix reported revenues of $9.37 billion, up 14.8% from the year-ago quarter. Also, it beat the average consensus estimate of $9.28 billion.

Top Analysts Have Mixed Opinions Post Q1 Results

Following the release of Q1 results, three Top Wall Street analysts maintained a Buy rating on NFLX stock, while two analysts assigned a Hold.

Investors should note that TipRanks ranks the Top analysts according to industry, timeline, and benchmarks. The ranking reflects an analyst’s ability to deliver higher returns through recommendations.

Is NFLX a Good Stock to Buy?

NFLX’s shares have gained 25.4% year-to-date, significantly outperforming the Nasdaq 100 Index (NDX) rally of 3.4%. Given this impressive rally, analysts’ average price target on Netflix stock of $637.29 implies a limited upside potential of 4.389%.

Overall, Wall Street is cautiously optimistic about the company. It has a Moderate Buy consensus rating based on 27 Buy, 12 Hold, and one Sell ratings.

Concluding Thoughts

The rollout of password-sharing restrictions and the focus on enhanced content creation are expected to help boost subscriber growth. Additionally, Netflix’s strong brand name, ad-supported tier offerings, and efforts to expand its ad business might continue to drive growth. Nevertheless, intense competition in the streaming market remains a key concern.