Streaming giant Netflix (NASDAQ:NFLX) is scheduled to announce its Q1 2024 earnings on April 18. The implementation of an ad-supported tier, solid content, and the focus on controlling costs will likely drive Q1 financials. While the paid membership base could decline sequentially, it will likely improve year-over-year.

It’s interesting to note that Netflix’s measures to monetize its platform efficiently, including efforts to address password sharing, member additions, and expansion of the ad business, bode well for future growth. However, NFLX stock has trended higher and appreciated nearly 86% in one year, which could limit the upside potential in the near term. Let’s dig deeper.

Netflix – Q1 Expectations

Wall Street expects Netflix to report revenue of $9.27 billion in Q1, up 13.6% from the prior-year quarter’s revenue of $8.16 billion. Moreover, analysts’ average revenue forecast is roughly in line with the management’s guidance.

The year-over-year improvement in its revenue, pricing optimization, and higher margins from the ad business will likely drive its bottom line. Analysts expect Netflix to post earnings of $4.49 per share in Q1, reflecting a significant improvement from $2.88 per share in the prior-year quarter.

Website Traffic Shows Growth

Netflix’s solid content and launch of the ad-supported tier continue to drive its user base and engagement on its platform. TipRanks’ website traffic screener reveals that NFLX’s traffic increased sequentially and year-over-year in Q1.

According to the tool, the number of visits to netflix.com increased by 16.61% sequentially in Q1. Moreover, website traffic jumped 48.72% year over year.

Learn how Website Traffic can help you research your favorite stocks.

Is Netflix a Buy, Hold, or Sell?

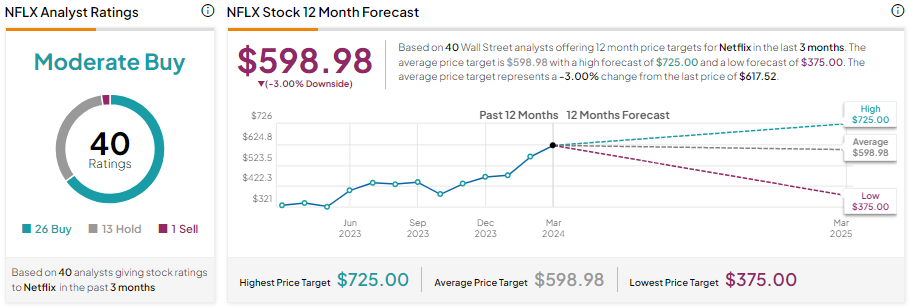

Given the significant increase in its price, analysts are cautiously optimistic about Netflix stock ahead of Q1 earnings. It has a Moderate Buy consensus rating based on 26 Buys, 13 Holds, and one Sell recommendation. The analysts’ average NFLX stock price target is $598.98, implying 3% downside potential from current levels.

Insights from Options Trading Activity

While Wall Street analysts’ average price target shows 3% downside potential, options traders are pricing in a +/- 8.63% move on earnings, smaller than the previous quarter’s earnings-related move of 10.7%.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.