While video streamer Netflix’s (NASDAQ:NFLX) earnings report didn’t exactly cross any investors’ eyes, turning in a beat for earnings and revenue, that didn’t stop a downright calamitous drop in share prices in Friday afternoon’s trading. Netflix was down nearly 9% after revealing it would no longer offer up data on subscriber rates.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

That’s a huge move for the company and not exactly a move in the right direction, as demonstrated by the plunge in share prices. But Netflix has a justification for no longer sharing those numbers, which would seem to be a critical metric of how well the company is doing overall.

The reason? Netflix has “evolved,” and with that evolution comes a whole new business model that isn’t so dependent on subscriber numbers. Netflix also revealed it would no longer share numbers about average revenue per member (ARM), thanks largely to its increased use of the ad-supported subscriber tier.

Fewer Numbers, More AI

That’s not the only change Netflix had on hand, either. Netflix also offered up some comments about the use of artificial intelligence (AI) in its operations, believing that it can help creators “…tell their stories in more compelling ways.” That sounds potentially exciting or disastrous, but Netflix wasn’t in a hurry to clarify this noble-sounding sentiment.

While Netflix has already been using AI in its operations with things like recommendation algorithms, there are certainly other potential avenues it can take. These include some downright worrisome ones, like replacing human storytellers with much less expensive—or perhaps more “compelling”—artificial ones.

What Is Netflix’s Target Price?

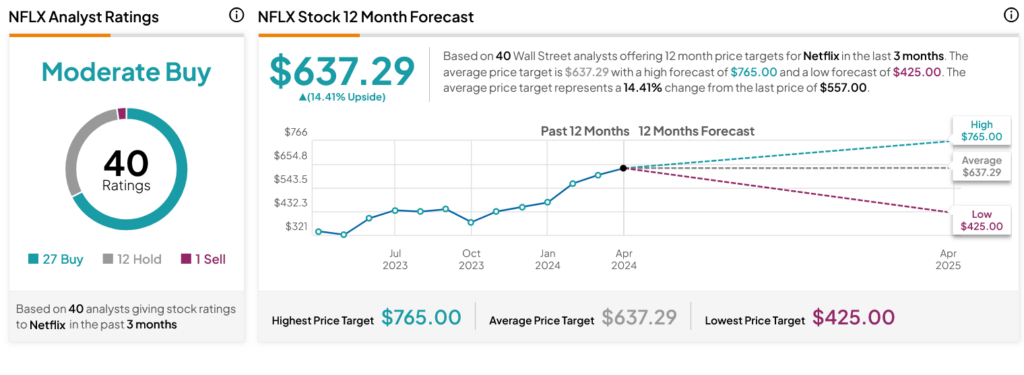

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NFLX stock based on 27 Buys, 12 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 70.99% rally in its share price over the past year, the average NFLX price target of $637.29 per share implies 14.41% upside potential.