Is streaming giant Netflix (NASDAQ:NFLX) looking over its shoulder at a potential new mega-merger in the streaming space? Probably not, at least not based on the latest reports out of Wedbush. In fact, Netflix investors gave Netflix stock a fractional boost amid positive words from Wedbush. Analyst Alicia Reese brought out the numbers, and they’re looking pretty good for Netflix.

Not only are total subscriber numbers up—though not by any astonishing amount—but so too is average revenue per user, at least as far as North America is concerned. The ad-supported tier is also looking like a bright spot, as more users are turning to that tier for their viewing. Interestingly, new and returning subscribers tend to opt for the ad-supported tier almost immediately, and the push to prevent account sharing is also doing well for Netflix overall.

Netflix is Frantically Working to Build Its Library of Content

Here’s where things start to get interesting. Netflix has been frantically working to build its library of streaming content, even in recent days. It’s working on a new series, “3 Body Problem,” for which it has a trailer and a complete “immersive experience” ready to show at this year’s CES in Las Vegas. Meanwhile, a Kristen Stewart movie that flopped, “Underwater,” is making a splash of its own on the platform.

This comes as major studios are reconsidering their options for streaming to the point where two—or potentially more—are considering mergers. If major studios start consolidating their positions, then Netflix might lose a lot of content quickly. So-called “catalog titles,” older titles licensed by studios, might get pulled out of play if the studios circle the wagons to defend their stake in streaming.

Is Netflix Stock a Buy, Sell, or Hold?

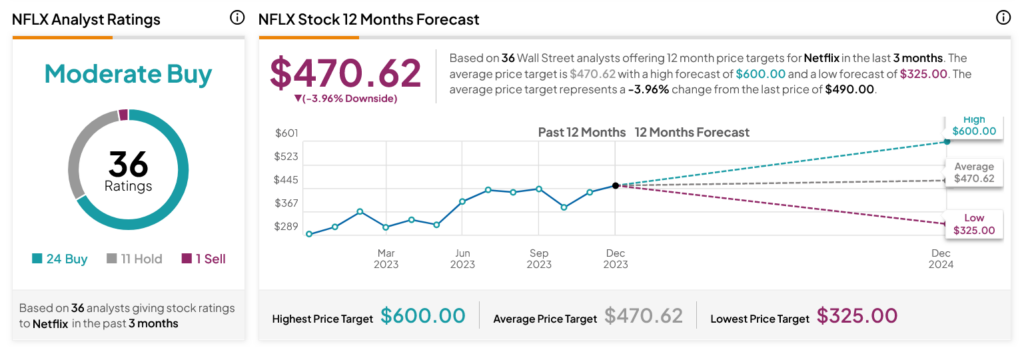

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NFLX stock based on 24 Buys, 11 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 64.39% rally in its share price over the past year, the average NFLX price target of $470.62 per share implies 3.96% downside risk.