On the surface, it would be easy to think that streaming giant Netflix (NASDAQ:NFLX) shot up over 15% in Thursday morning’s trading because of its fantastic earnings report. Because it did. Despite this, however, there are some analysts who are concerned that the incredible results from this quarter might be little more than a paper tiger ready to collapse.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Leading the charge of the dark brigade was Goldman Sachs. Goldman Sachs analysts did give credit where due, noting that the report turned out “…much better than feared” and that Netflix managed to “…outperform…certain recently lowered expectations.” But then, Goldman Sachs turned on Netflix and noted that there was “…likely to be some continued debates about the linearity of growth and margin performance…” as well as how Netflix “…will navigate through the wider media consumption landscape…”

Goldman Sachs wasn’t the only malcontent herein; Barclays also showed up to kick Netflix when it was up, noting that the results Netflix posted were certainly, objectively, good but that those results might not mean much when the time comes to make next year’s estimates, or even in the years to come. Barclays pointed out that the price increases in the last two quarters, thanks to the paid sharing plan, means that the subscriber growth seen in the third quarter is roughly comparable. However, those comparisons promptly fall apart when used as a metric going forward thanks to the “…major + / – few million variance caveat….”

Is NFLX Stock a Good Buy?

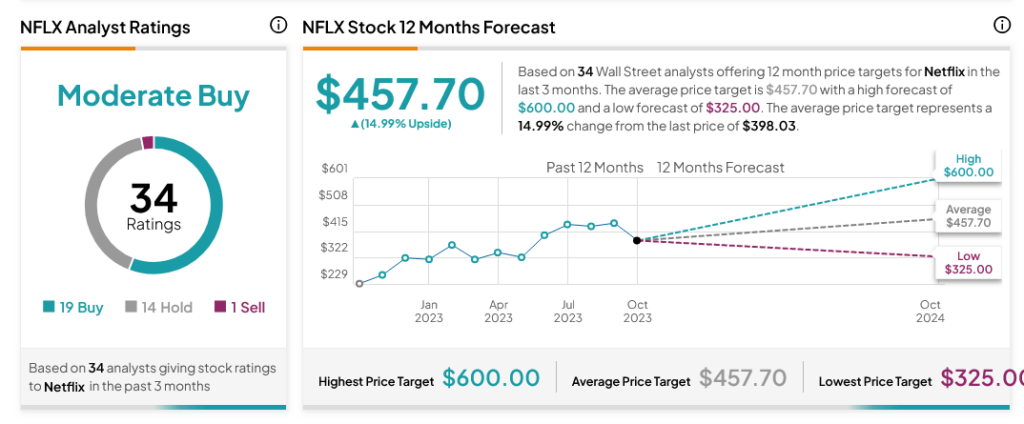

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NFLX stock based on 19 Buys, 14 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average NFLX price target of $457.70 per share implies 14.99% upside potential.