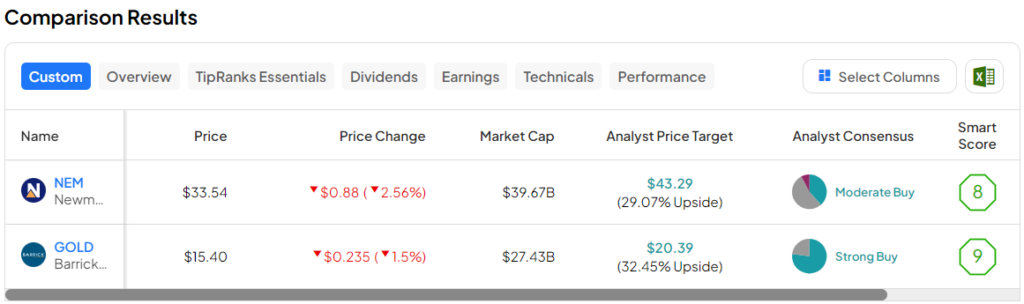

In this piece, I evaluated two gold mining stocks, Newmont (NYSE:NEM) and Barrick Gold (NYSE:GOLD), using TipRanks’ comparison tool to see which is better. A closer look suggests a neutral view for Newmont and a bullish view for Barrick Gold.

Newmont holds the world’s largest gold reserve base within the industry and mines gold, copper, silver, zinc, and lead. Meanwhile, Barrick Gold mines gold and copper and conducts related activities like exploration and mine development.

Shares of Newmont have tumbled 18% year-to-date and are down 27% over the last year, while Barrick Gold stock has slipped 14% year-to-date and is off 13.6% over the last 12 months.

With these drops in the two largest gold miners over the past year, some investors may be surprised that the gold price has actually skyrocketed. Spot gold has climbed from a little over $1,800 per ounce in early and touched a record high of $2,195 per ounce on March 8.

In fact, based on the soaring gold price, gold miners haven’t been this cheap relative to gold in more than 25 years, according to capital markets firm Sprott. The firm reported in early January that “the spread between the gold price and the discount implied to spot based on the market prices of the equities [was] a massive $700+ an ounce.”

“In other words, cash flow from a gold price 65% of the current spot price would return the entire market value of the group based on existing reserves,” the author added.

Since Sprott’s report, the share prices of Newmont and Barrick Gold have continued to drop while the spot gold price has kept marching higher, widening that valuation gap further.

Unfortunately, Newmont is not profitable currently, so we’ll compare the two companies’ price-to-sales (P/S) multiples to gauge their valuations against each other and against that of their industry. For comparison, the broader gold-mining industry is trading around its three-year average P/S of 3.8.

Of course, a closer look at both companies is needed to determine which presents better value.

Newmont Mining (NYSE:NEM)

At a P/S of 3.3, Newmont is trading at a small discount to the gold-mining industry. However, a series of problems have plagued the miner recently, suggesting a neutral view may be appropriate — pending progress on those issues.

One reason to hold gold stocks instead of directly holding the metal itself is the attractive dividends many miners pay. However, Newmont recently slashed its quarterly dividend by 37% from 40 cents to 25 cents per share, reducing the incentive for holding the stock.

Going forward, Newmont management expects a base annualized dividend of $1 per share, putting the company’s dividend yield at around 3%. While that’s a decent yield, the recent dividend cut should give investors pause, especially since the company’s payout ratio is negative based on last year’s loss.

At an expected annualized dividend of $1 per share for the coming year and using Newmont’s full-year net loss of $2.97 per share from continuing operations in 2023, its payout ratio comes to -33.7%. Thus, if Newmont continues to post losses, it could face further cuts to its dividend.

Additionally, investors have penalized Newmont for several issues, including its acquisition of Newcrest Mining, which was finalized in November. Other issues were cemented in Newmont’s most recent releases.

While the company’s mineral reserves jumped 41.5% year-over-year to 135.9 million ounces due to that acquisition, its production guidance of 6.93 million ounces of gold in 2024 disappointed investors. Newmont now plans to sell non-tier 1 assets for about $15 billion to bring its minimum cash balance back up to $3 billion and pay down some of its $8.9 billion in debt. The company also posted a sizable net loss of $3.21 per diluted share in the fourth quarter.

Other assorted problems included a significant production loss at Newmont’s Penasquito mine in Mexico, which triggered a $1.2 billion non-cash impairment in the fourth quarter, the wildfires in Canada, which impacted the Eleonore mine, and the delay and increased cost of the Tanami project.

While Newmont isn’t going anywhere anytime soon, these issues will take some time to work through. Perhaps at an even steeper discount, I could get more constructive, but I’m not there yet.

What Is the Price Target for NEM Stock?

Newmont has a Moderate Buy consensus rating based on five Buys, seven Holds, and one Sell rating assigned over the last three months. At $43.32, the average Newmont stock price target implies upside potential of 29.2%.

Barrick Gold (NYSE:GOLD)

At a P/S of 2.4, Barrick Gold is trading at an even steeper discount than Newmont. Between that discount versus the gold price and the company’s attractive dividend and execution, a bullish view seems appropriate.

Barrick Gold pays a dividend of 2.6%, with a payout ratio of 47.12%, making the company an attractive dividend stock. It also recently announced a new share buyback program of up to $1 billion, which makes perfect sense in light of the recent plunge in its valuation and the sizable discount versus the gold price, as explained above.

Additionally, its fundamentals and execution are solid, as would be expected for a gold miner of its size. In the most recent quarter, Barrick reported adjusted earnings of 27 cents per share on $3.08 billion in revenue versus the consensus numbers of 20 cents per share on $3.08 billion in revenue.

The company is also diversifying into copper, recently announcing an expansion project at one of its two copper-producing mines. In fact, Barrick’s copper production is expected to double this year from 260 million pounds in 2023 to 528 million pounds per year following this expansion.

With gold above $2,000 per ounce and copper nearing $4 a pound, Barrick’s split is now roughly 75% gold and 25% copper. Unfortunately, Barrick’s full-year gold production slipped 2.17% year over year in 2023, falling to 4.05 million ounces due to equipment problems and lower output at two of its Nevada mines.

The company’s copper production also declined to 420 million pounds in 2023. Analysts had expected 4.16 million ounces and 433 million pounds of copper. However, Barrick’s output did increase sequentially in the fourth quarter, jumping to 1.05 million ounces of gold and 113 million pounds of copper.

From an execution standpoint, the miner has remained profitable on an annual basis during problematic periods for the gold-mining industry. Additionally, the rising gold price has enabled it to expand its net income margin from 3.9% in 2022 to 11.2% in 2023.

In short, the long-term trends for Barrick look particularly attractive right now, making the recent drawdown in its stock price a buy-the-dip opportunity.

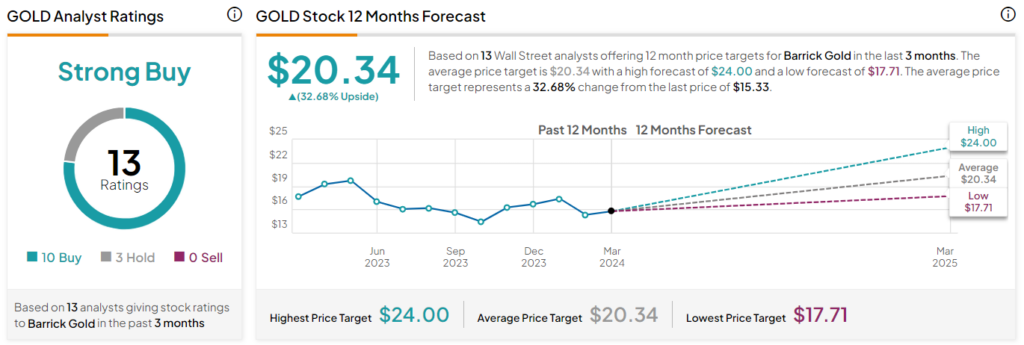

What Is the Price Target for GOLD Stock?

Barrick Gold has a Strong Buy consensus rating based on 10 Buys, three Holds, and zero Sell ratings assigned over the last three months. At $20.34, the average Barrick Gold stock price target implies upside potential of 32.7%.

Conclusion: Neutral on NEM, Bullish on GOLD

Gold is widely considered to be a safe-haven asset, which makes the recent strength in gold prices quite interesting due to the robust U.S. economy and high interest rates. However, when the Federal Reserve starts cutting rates, gold usually becomes even more attractive to investors because the benefit of holding cash disappears as interest rates fall.

As a result, the recent record-high gold prices and expectations of a more attractive environment for gold make this an excellent time to be looking at gold miners. However, the plethora of problems plaguing Newmont currently makes Barrick the better buy of the two, especially considering its attractive and much safer dividend.