Being a gold miner like Newmont Mining (NYSE:NEM) would seem to be a good play, especially in uncertain economic times. But Newmont’s 5% drop in Thursday’s trading shows that even a company that pulls money out of the ground, by way of gold, can still have trouble when the circumstances aren’t properly aligned.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

There are really only two ways for a gold miner to lose money. One, the cost of pulling that gold out of the ground—or riverbed, permafrost, or wherever it currently resides—exceeds the value of the gold itself. Two, the miner pulling the gold can’t find enough of it to cover the costs, regardless of whether or not they’ve changed. For Newmont, it’s actually both of these at once; Newmont is off the gold, and finding less of it, at a time when the costs of extracting gold are on the rise.

Several factors slammed into Newmont, starting with labor troubles in Mexico—which included a few strikes—and the Canadian wildfires that have dropped choking clouds of smoke into the U.S for the last several weeks now. Indeed, Newmont’s second quarter earnings proved a serious problem, with both earnigns and revenue missing by healthy margins. However, Newmont remains optimistic, and expects its full-year guidance figures to ultimately come out. Newmont looks to extract between 5.7 million and 6.3 million ounces of gold.

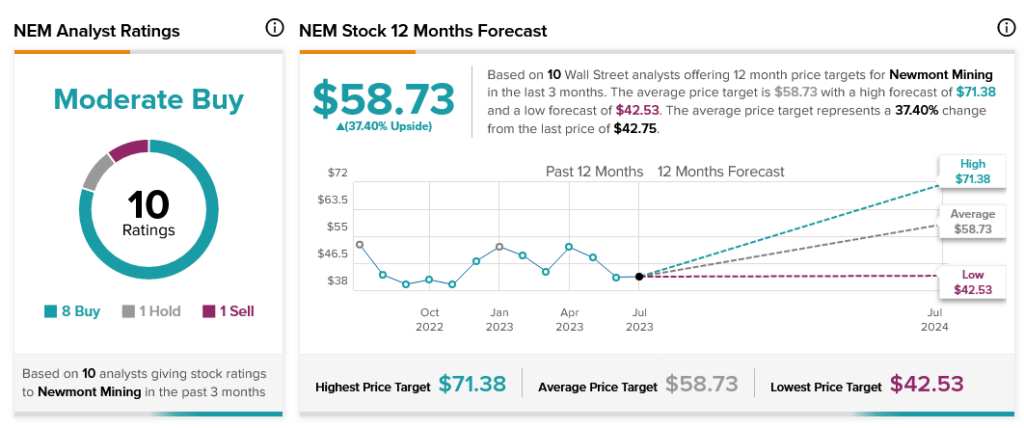

Analysts are feeling about as optimistic as Newmont Mining itself. With eight Buy ratings, one Hold and one Sell, Newmont Mining stock has an analyst consensus rating of Moderate Buy. Meanwhile, with an average price target of $58.73, Newmont Mining stock offers investors a 37.4% upside potential.