Newmont (NEM), the world’s largest gold miner, has posted third-quarter financial results that beat Wall Street forecasts across the board.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

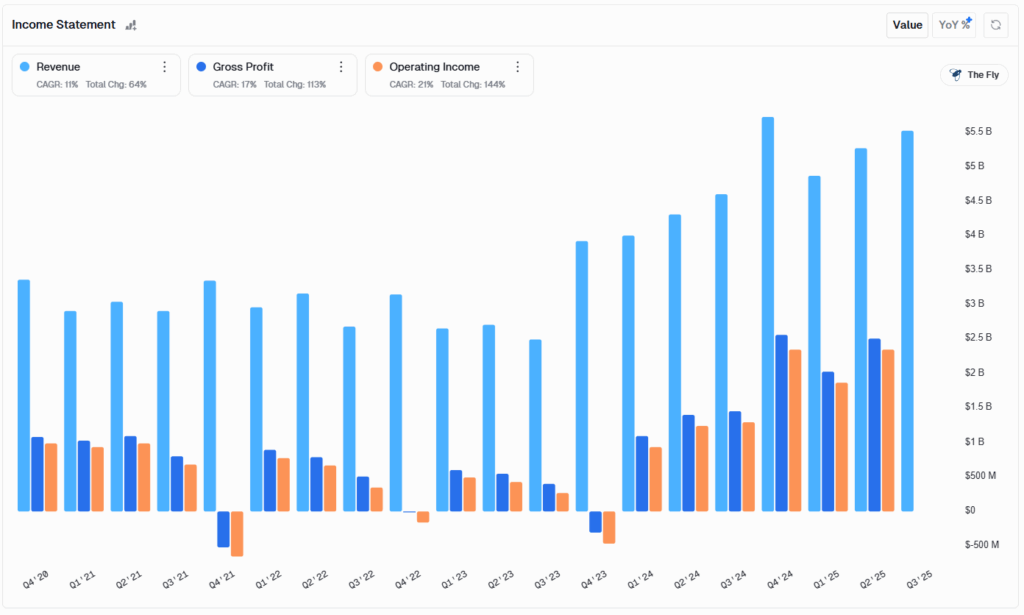

The Denver, Colorado-based company announced Q3 earnings per share (EPS) of $1.71, which was much higher than the $1.44 expected on Wall Street. Revenue in the July through September period totaled $5.52 billion, which topped the consensus estimate of $5.19 billion.

The strong print comes as gold’s price continued to rally throughout this year’s third quarter, hitting successive new highs during the three-month period and rising above $4,000 per ounce for the first time. The third quarter results continue a string of earnings beats for the mining company this year.

Newmont’s income statement. Source: Main Street Data

Gold Pullback

Newmont’s stock had been volatile in the days leading up to the Q3 financial results being made public. After rising more than 60% this year, gold’s price dropped sharply in recent days, pulling NEM stock down alongside it.

However, Wall Street analysts remain bullish on gold over the long-term and see the recent pullback as temporary or the result of profit taking by investors. Despite its recent drop, NEM stock is up 140% this year, having benefited from record high prices for the gold it extracts.

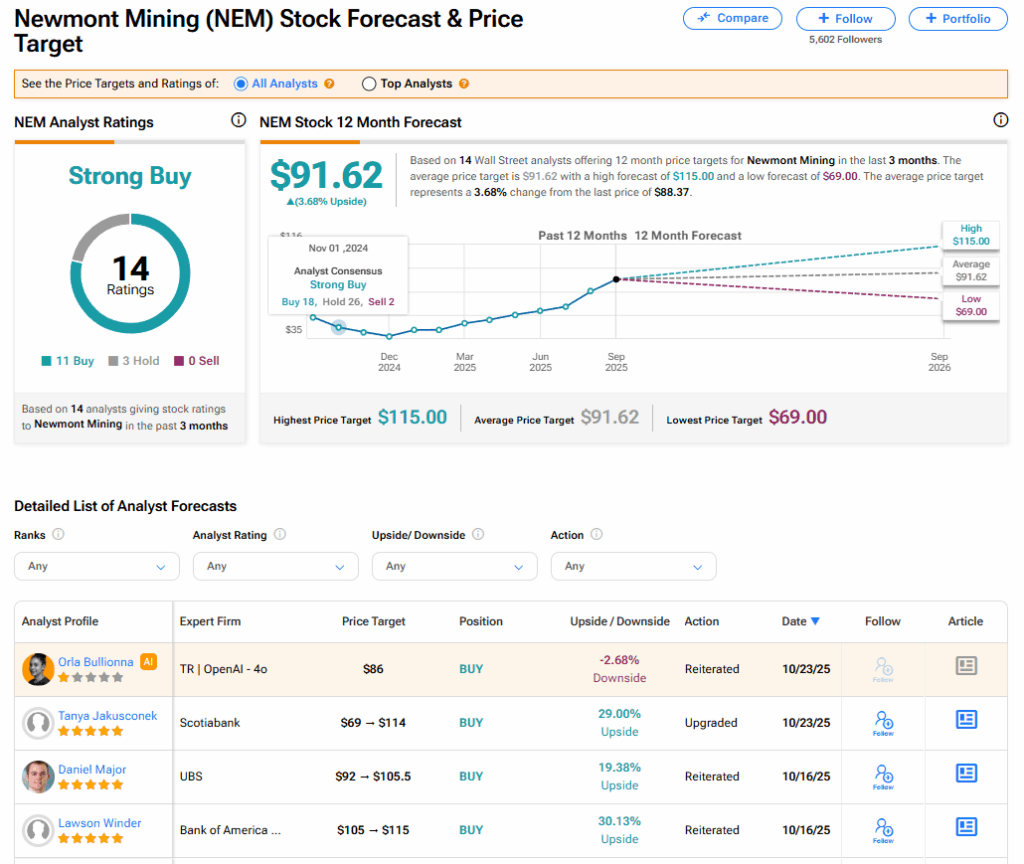

Is NEM Stock a Buy?

The stock of Newmont has a consensus Strong Buy rating among 14 Wall Street analysts. That rating is based on 11 Buy and three Hold recommendations issued in the last three months. The average NEM price target of $91.62 implies 3.68% upside from current levels. These ratings could change after the company’s financial results.