The stock of Newmont Corp. (NEM) is up 2% on Oct. 23, hours before the world’s biggest gold miner is scheduled to report its third-quarter financial results.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

NEM stock had crashed in recent days alongside the price of gold, falling 8% in the past five trading sessions. However, Newmont’s stock is now rallying into its earnings print. The stock’s rise coincides with a 2% gain in the price of gold.

Bullion had experienced a sharp pullback this week after its price rose more than 60% this year, hitting new all-time highs on more than 30 separate occasions. Analysts said a pullback in gold was to be expected after such a strong rally.

Earnings Expectations

Despite the volatility in gold, Newmont is expected to announce strong top and bottom line numbers, driven by the record run in gold’s price. Wall Street is expecting Newmont to post earnings per share (EPS) of $1.27 for the quarter ended Sept. 30. That would be up 57% from $0.81 per share reported a year earlier.

The mining company has been beating consensus forecasts all year, topping Wall Street’s earnings outlook by 49% in the first quarter and 38% in the second. Despite its recent drop, NEM stock is up 140% this year, having benefited from record high prices for the gold it extracts from the ground.

Is NEM Stock a Buy?

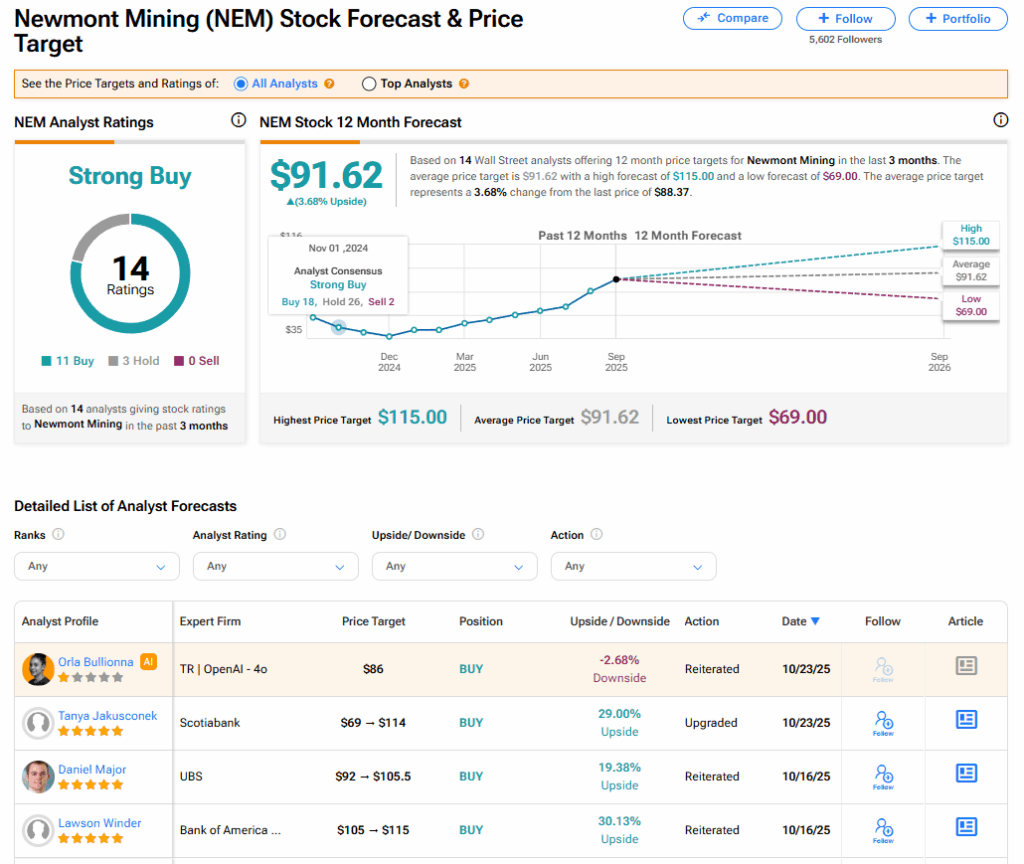

The stock of Newmont has a consensus Strong Buy rating among 14 Wall Street analysts. That rating is based on 11 Buy and three Hold recommendations issued in the last three months. The average NEM price target of $91.62 implies 3.68% upside from current levels.