U.S. insurer Allstate Corp. (ALL) has agreed to acquire National General Holdings Corp.(NGHC) for about $4 billion in cash, or $34.50 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As part of the takeover deal National General shareholders will get $32 per share in cash and closing dividends of $2.50 per share. The $34.50 total value per share reflects a 69% premium to National General’s closing price on Tuesday. National General shares spiked 69% to $34.39 in Wednesday’s pre-market trading.

Allstate will fund the share purchase by using $2.2 billion in combined cash resources and issuing $1.5 billion of new senior debt. The insurer said it will maintain its current share repurchase program.

“Acquiring National General accelerates Allstate’s strategy to increase market share in personal property-liability and significantly expands our independent agent distribution,” said Allstate CEO Tom Wilson said. “The acquisition increases personal lines premiums by $4 billion and market share by over 1 percentage point to 10%.”

Wilson added that the deal is expected to be accretive to adjusted net income earnings per share and return on equity beginning in the first year of the purchase. The transaction is expected to close in early 2021, subject to regulatory approvals and other customary closing conditions.

New York-based National General provides a wide range of property-liability products through independent agents with a significant presence in non-standard auto insurance. The company also has accident and health and lender-placed insurance businesses. In 2019, written gross premiums amounted to $5.6 billion and generated operating income of $319 million.

National General’s board of directors has approved the transaction including a breakup fee of $132.5 million. A voting agreement has also been signed with entities controlling 40% of National General’s common shares to vote for the transaction.

Allstate shares have dropped 18% this year as the lockdown mandates tied to the coronavirus pandemic curtailed insurers’ businesses. The stock fell 2.3% to $90.50 in pre-market trading.

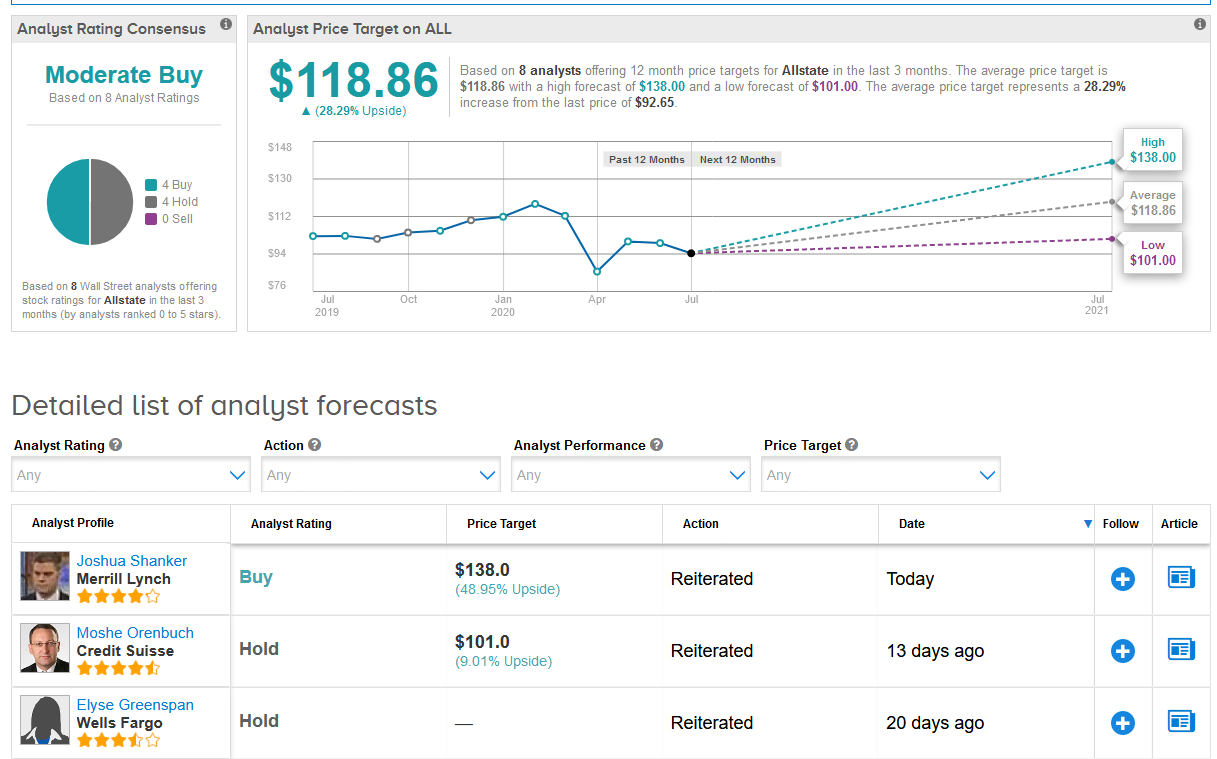

In reaction to the deal, Merrill Lynch analyst Joshua Shanker reiterated a Buy rating on the stock with a $138 price target (49% upside potential), saying that Allstate is giving up $90-$100 million of annual income to receive about $350 million in National General income, which he believes is a “conservative assumption”.

“We are not confident that National General can help Allstate with its sluggish organic revenue growth, but, while Allstate shares may react negatively to this news – as is often the case with acquirers – we expect consensus EPS numbers will rise as models incorporate the new income stream,” Shanker wrote in a note to investors.

Overall, Wall Street analysts are divided on the stock between 4 Buys and 4 Holds adding up to a Moderate Buy rating. The $118.86 average price target implies 29% upside potential to current levels. (See Allstate stock analysis o TipRanks).

Related News:

Sunrun To Buy Vivint Solar For About $1.46B In All-Stock Deal

Billionaire Buffett’s Energy Unit To Buy Dominion Energy Assets For $4B

Google, Temasek Are Said To Be In Talks To Invest Up To $1B In Tokopedia