The Nasdaq 100 (NDX) has completely reversed its 1.38% morning drop despite the effects of Moody’s (MCO) credit downgrade and comments made by Treasury Secretary Scott Bessent over the weekend.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

On Friday, Moody’s downgraded U.S. credit rating from the highest-level, Aaa, to the second-highest level, Aa1. The credit rating agency cited higher government debt and interest burdens amid a rising fiscal deficit. Moody’s is the last of the three major credit rating agencies to reduce the U.S.’ rating to the second-highest level, with Fitch and Standard and Poor’s lowering their ratings in 2023 and 2011, respectively.

Meanwhile, Treasury Secretary Scott Bessent stirred tariff fears after appearing in a CNN interview on Sunday. Bessent added that tariffs on other countries could return to “reciprocal” levels.

“President Trump has put them on notice that if you do not negotiate in good faith, you will ratchet back up to your April 2 level,” said Bessent.

The Nasdaq 100 is up by 0.13% at the time of writing.

Which Stocks are Moving the Nasdaq 100?

Let’s take a look at TipRank’s Nasdaq 100 Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Higher-flyers Tesla (TSLA) and Palantir (PLTR) are taking a breather with losses nearing 3%. Both stocks are still up by over 35% during the past month. Meanwhile, Microsoft (MSFT) and Broadcom (AVGO) are helping revive the index with gains of nearly 1% while AI chip leader Nvidia (NVDA) is practically unchanged on the day.

QQQ Stock Moves Higher with the Nasdaq 100

The Invesco QQQ Trust (QQQ) is an exchange-traded fund (ETF) designed to track the movement of the Nasdaq 100. As such, QQQ is rising in correlation with the Nasdaq 100 today.

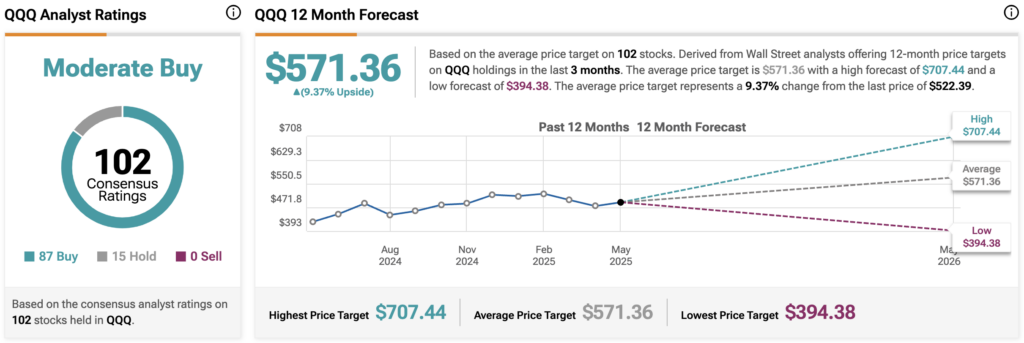

Wall Street has high expectations for QQQ stock. During the past three months, analysts have issued an average QQQ price target of $571.36 for the stocks within the index, implying upside of 9.37% from current prices. The 102 stocks in the QQQ carry 87 buy ratings, 15 hold ratings, and zero sell ratings.