Billionaire Elon Musk has been wrestling with rejection since the day he acquired the social media platform Twitter. In a series of tweets yesterday, Musk lambasted iPhone maker Apple (NASDAQ:AAPL) for its stance on free speech and censorship norms.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

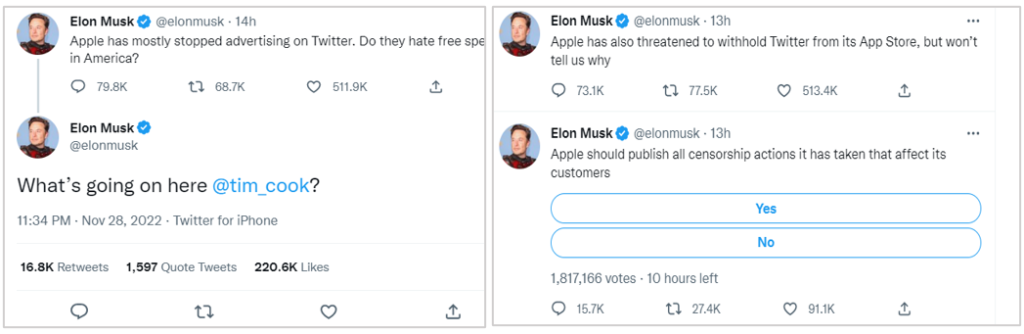

After withdrawing most of its advertising spend on Twitter, Apple is now even thinking of withdrawing Twitter downloads from its App Store. “Apple has also threatened to withhold Twitter from its App Store, but won’t tell us why,” Musk quoted. “What’s going on?” he openly questioned Apple CEO, Tim Cook, in his usual blatant style.

What’s more, Musk went on to post a poll asking if “Apple should publish all censorship actions it has taken that affect its customers.” Additionally, Musk criticized Apple for putting a “30% tax on everything you buy through their App Store.”

The bitterness between Musk and Cook began years back in 2018, when the former’s brainchild, Tesla (NASDAQ:TSLA) was struggling with finances to produce its Model 3 electric vehicles (EVs.) Musk reportedly approached Cook for financial assistance or the possibility of selling Tesla to Apple, but the latter refused to assist. Cook insists that he has never discussed the matter with Musk.

Moreover, Apple is accused of poaching several engineers from Tesla in its attempt to enter the automobile industry.

Why is Tesla’s Stock Dropping?

Musk’s Twitter escapades are taking a toll on Tesla’s stock. Shareholders are fretting about the consequences for Tesla’s future should Musk continue to put more emphasis on Twitter at the cost of Tesla’s journey.

Year to date, TSLA stock is down 54.3%, while the stock has lost nearly 19% since October 27, the day Musk took over Twitter.

Even analysts remain split on TSLA’s stock trajectory. On TipRanks, the stock has a Moderate Buy consensus rating based on 18 Buys, eight Holds, and two Sells. The average Tesla price target of $306.79 implies 67.7% upside potential to current levels.