The artificial intelligence market may be looking at a sea change in the short term as Elon Musk looks to enter the field with xAI. The plan offered up a halo effect to several other AI stocks, with Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), and Google (NASDAQ:GOOG) (NASDAQ:GOOGL) all up fractionally in Friday morning’s trading as a result.

Musk’s planned AI startup, xAI, is already making the rounds of discussion and pulling some impressive talk about valuation, too. Reports suggest it could raise as much as $6 billion against a potential valuation of $20 billion. Musk has been on a world tour to raise cash, working with Middle East sovereign wealth funds and Hong Kong family offices to land the dough.

Interestingly, xAI itself had previously only expressed a goal of $1 billion but is well on track to raise significantly more than that. Although $20 billion would still be far behind OpenAI, it would be a rough match for Google’s creature Anthropic.

The Big Names are in the Firing Line

Musk’s startup comes at an interesting time for AI; it turns out that Microsoft, Amazon, and Google are all now under a Federal Trade Commission (FTC) investigation over their connections to the various AI projects they’re supporting. Right now, it seems mostly fact-finding, but given the nature of such investigations, it could turn predatory quickly. The FTC plans to “…scrutinize corporate partnerships and investments with AI providers to build a better internal understanding of these relationships and their impact on the competitive landscape.” That, in turn, might mean good news for Musk, who will certainly be coming in as a competitor to these platforms.

Which AI Stocks are a Good Buy Right Now?

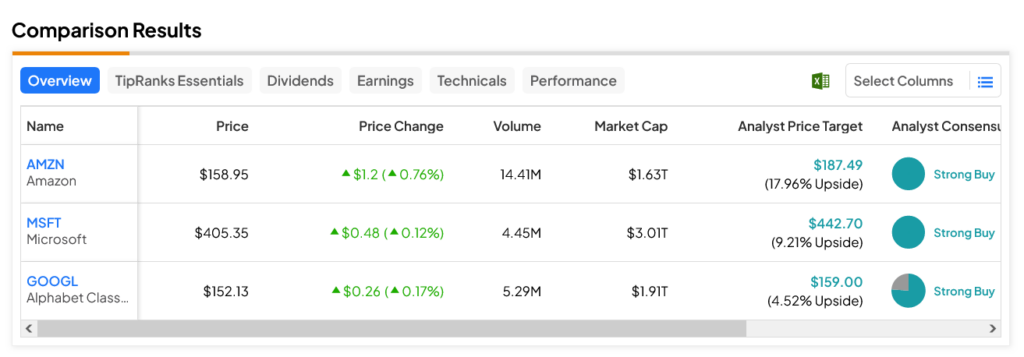

Turning to Wall Street, Strong Buy-rated AMZN stock is the clear leader among the three mentioned today, with a 17.96% upside potential on its $187.49 average price target. Meanwhile, GOOGL stock is the laggard, as this Strong Buy with a $159 price target can only offer a 4.52% upside potential.