Dividend stocks can be a great boon for investors looking for regular income and stable returns. Today, we will look at two Canadian dividend-paying companies that analysts love and are ranked as Strong Buy on TipRanks. These companies pay meaningfully high dividends when compared to the sector averages, implying sound financials and future potential.

Mullen Group Ltd. (TSE:MTL)

Alberta-based Mullen Group is a holding company with diverse businesses in the trucking and logistics space. Furthermore, Mullen Group provides specialized services like water management, fluid hauling, and environmental reclamation to the energy, mining, forestry, and construction industries.

MTL will pay its upcoming monthly dividend of C$0.06 per share on March 15, 2024. This dividend represents a current yield of 4.88%, much higher than the sector average of 1.6%.

Notably, Mullen is rewarding shareholders by steadily increasing its per month dividend over the years. For full-year 2023, Mullen paid cash dividends of $0.72 per share, up 5.9% from $0.68 per share paid in 2022.

Is Mullen Group a Good Buy?

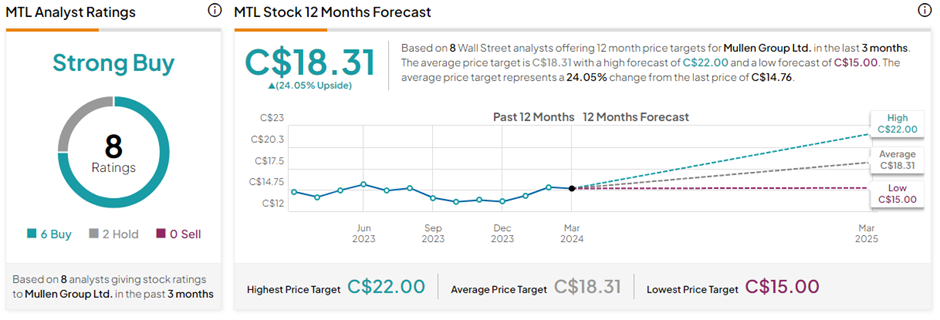

On TipRanks, MTL has a Strong Buy consensus rating based on six Buys and two Hold ratings. The average Mullen Group share price target of C$18.31 implies 24% upside potential from current levels. In the past year, MTL stock has gained 1.6%.

B2Gold Corp (TSE:BTO)

Vancouver-based B2Gold is a low-cost international senior gold producer with mining operations in Mali, Namibia, and the Philippines. The company also has mining projects under progress in Northern Canada, Mali, Colombia, and Finland. For Fiscal 2024, B2Gold projects total consolidated gold production between 860,000 and 940,000 ounces.

During its Fiscal 2023 results, B2Gold’s board proposed a dividend of $0.04 per share for Q1 FY24, payable on March 20, 2024. This reflects an attractive dividend yield of 6.07%, significantly higher than the industry average of 1.879%.

Is BTO a Buy?

With 10 Buys versus one Hold rating, BTO stock commands a Strong Buy consensus rating on TipRanks. The average B2Gold share price forecast of C$5.75 implies 59.4% upside potential from current levels. Meanwhile, BTO stock has lost 24.8% in the past year.

Key Takeaways

Investing in well-paying dividend stocks can be a good way to diversify your portfolio and stabilize its returns. Furthermore, the above two stocks not only pay regular dividends but also promise share price appreciation as per analysts’ consensus price target.