M&T Bank Corporation (NYSE: MTB) has progressed further on its pending acquisition of a Bridgeport, CT-based bank holding company, People’s United Financial, Inc. (PBCT). M&T Bank has received the final regulatory approval from the Federal Reserve System’s Board of Governors for this transaction.

The all-stock deal was signed by the parties in February 2021 and was originally expected to conclude in the fourth quarter of 2021.

Shares of this financial holding company declined 2.4% to close at $176.22 on Friday.

Based in Buffalo, NY, M&T Bank provides commercial and retail banking services. It also provides wealth management, trust, and investment services. In 2021, the company’s interest income was $3.9 billion and earnings were $13.80 per share.

Background

In February 2022, the parties to the transaction extended their agreement to June 1, 2022, from February 21, 2022.

In October 2021, the merger was approved by the Connecticut Department of Banking and the New York State Department of Financial Services.

In July 2021, M&T Bank announced that the Bridgeport, CT-based headquarter of People’s United will be the regional base in New England for the combined company (consolidated operations of M&T Bank and People’s United).

In May 2021, shareholders of both companies provided the necessary approvals for the transaction.

In February 2021, M&T Bank communicated that it would acquire People’s United for $7.6 billion. Upon completion of the acquisition, the combined company, a regionally-focused franchise, will have 2,000 ATMs, 1,100 branches, and assets worth $200 billion. Of the total holding in the combined company, 28% will be with the shareholders of People’s United and the rest will be with the shareholders of M&T Bank.

M&T Bank expected immediate accretion to its book value per share (tangible) and predicted cost synergies of $330 million through 2023. It also projected accretion, to the tune of 10%-12%, to its earnings per share in 2023.

M&T Bank’s Chairman and CEO, Rene Jones, had then said, “Combining our common legacies and our complementary footprints will strengthen our ability to serve our communities and customers, and provide solutions that make a difference in people’s lives.”

Wall Street’s Take

Recently, Ken Usdin, an analyst at Jefferies, maintained a Hold rating on M&T Bank while increasing the price target to $192 (8.95% upside potential) from $181.

Overall, the Street is cautiously optimistic on M&T Bank and has a Moderate Buy consensus rating based on 5 Buys and 5 Holds. The average MTB price target of $188.10 suggests 6.74% upside potential from current levels. Over the past year, shares of M&T Bank have gained 14%.

Risk Analysis

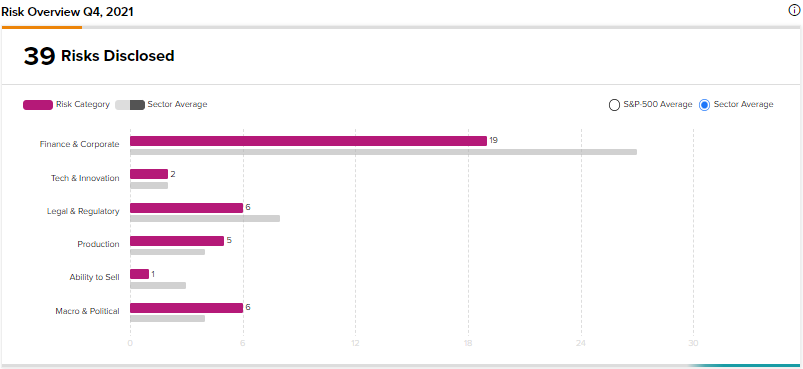

TipRanks Risk Factors tool reveals that MTB stock is at risk mainly from Finance & Corporate factor, which contributes 19 risks to the total 39 risks identified for the stock.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Emerson Electric Agrees to Sell Therm-O-Disc to One Rock

Welbilt Sells Manitowoc Ice Business to Pentair for $1.6B

SoFi Concludes Acquisition of Technisys