The generative artificial intelligence (AI) race is on, and thus far, I think it’s safe to say that Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) are leading the pack, perhaps by a wide margin. Undoubtedly, just because the two AI frontrunners are ahead in the race right now doesn’t mean they’ll stay on the throne in a couple of years’ time. In such a rapidly advancing field, investors better be prepared for anything to happen.

Further, it’s harder than you’d think to differentiate the long-term winners from the losers at the cusp of a new technological trend. It was tough to grasp which companies would rise from the advent of the internet. And it’ll probably not be easy for investors to spot the next big startup in the generative AI scene. In the meantime, I’m not against betting on both AI frontrunners and am staying bullish on both stocks.

Don’t Bet Against These Companies as They Battle for First Place

As two companies that have lived through the dot-com era to become some of the largest corporations on the planet, a strong case could be made that the winners of the internet age could pull a repeat in the age of generative AI. At this juncture, it’d be pretty unwise to bet against either company as they look to go all-in on their large language models (LLMs).

Microsoft’s stake in OpenAI has paid off big-time. And it’s an investment that could keep on giving as Sam Altman and his team look to lead the charge. There is pretty stiff competition that’s emerged from the AI shadows in recent years, however. They simply cannot be ignored as a growing number of LLMs look to showcase their specs, comparing themselves to the likes of ChatGPT or whoever happens to be the market leader at any given instance.

This past week, OpenAI rival Anthropic, a small firm in which Google owns a hefty stake, launched Claude 3 (the latest version of its flagship LLM). The highly capable AI model may very well be the answer to GPT-4. Either way, the AI race may be a tad closer than previously thought. This goes to show just how quickly the AI landscape can shift with the drop of a new language model.

Google Can Move on from Its Rough Start in AI

Google has its own model, Gemini, which has faced harsh criticism lately. The latest debacle surrounds its problematic Gemini image generator. Even founder Sergey Brin admitted that the firm “messed up.” Indeed, Google showed us all that there are risks of flooring it when it comes to AI.

As AI advances, the last thing tech companies should shoot for is to move fast with less regard for breaking things. Indeed, I believe the messy image generator launch is easily fixable. But what’s not so easy to fix is the tarnish the embarrassing blunder may have left on Google and its AI endeavors.

To quote Warren Buffett, “It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.”

Google has been around for just north of 20 years, building a pretty strong reputation for itself. These days, though, it seems like the company’s AI prowess has been discounted as a result of the latest AI blunder. Whether Google learns from the experience is a multi-trillion-dollar question.

GOOGL Stock’s Discount Seems Excessive, But Search Is Vulnerable

At writing, GOOGL stock stands out as the cheapest (at least on the front of price-to-earnings) of the Magnificent Seven, currently going for 19.4 times forward price-to-earnings (P/E). That’s not just cheap; it’s absurdly cheap for what many would consider the number two AI play out there right now.

The latest near-15% pullback off its all-time highs stands out as more of an opportunity than a sign to run for the hills before Google has a chance to get ahead of its skis again with Gemini. That said, there are reasons for the discount, and in the case of Google, the risk lies in what the firm stands to lose in the business of search as AI companies set their crosshairs on answering questions.

Startups like Perplexity offer a unique product that has profoundly disruptive potential for the search giant. Combining search, an intuitive interface, and numerous LLMs to select from (including Claude 3, GPT-4 Turbo, and its very own Perplexity model), the AI unicorn may just pull off what Microsoft struggled to do for years with Bing.

Is GOOGL Stock a Buy, According to Analysts?

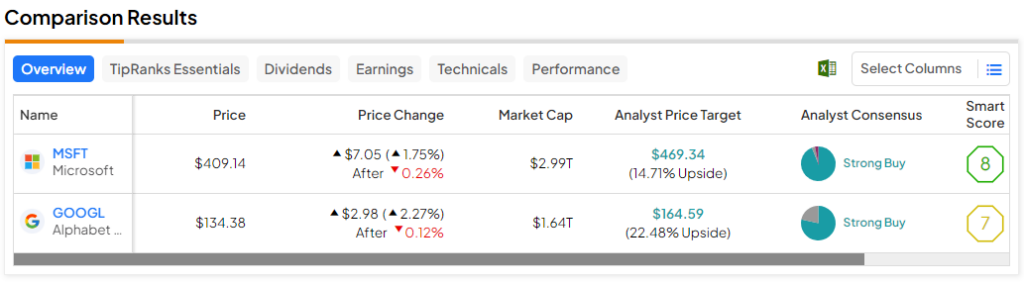

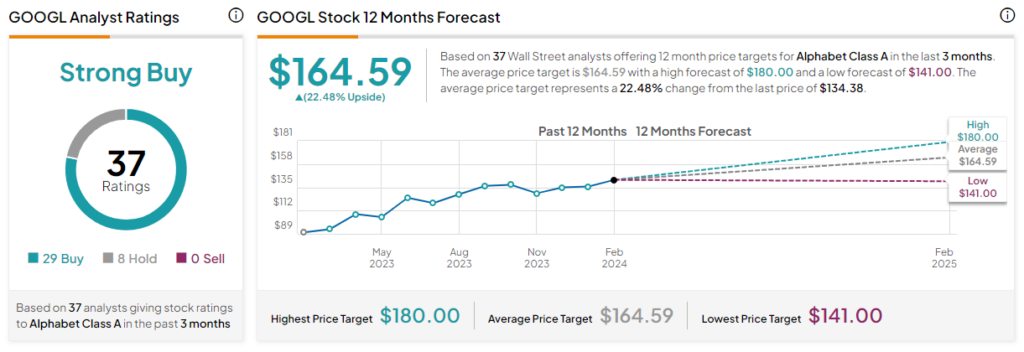

GOOGL stock is a Strong Buy, according to analysts, with 29 Buys and eight Holds assigned in the past three months. The average GOOGL stock price target of $164.59 implies 22.5% upside potential.

Microsoft’s AI Lead at Risk if Musk Wins Battle Against OpenAI

Microsoft, the likely number-one player in AI, isn’t without its fair share of risks, either. Elon Musk recently filed a lawsuit against OpenAI and Sam Altman over the firm’s abandoning of its initial mission in pursuit of profit. Only time will tell what comes to be of the suit. Regardless, Musk seems to want OpenAI to return to its roots as a non-profit organization, even if it means breaking a contract with the world’s largest company.

Personally, I don’t think Musk will have his way. However, he does have a puncher’s chance of getting his way. If he does, it’s unclear what the implications will be for Microsoft and its stance in the AI race. Nonetheless, such a scenario would have to have a negative impact on the firm, which seems richly valued at more than 30x forward price-to-earnings. This is a multiple that entails a lead in AI.

Is MSFT Stock a Buy, According to Analysts?

MSFT stock is a Strong Buy, according to analysts, with 31 Buys, one Hold, and one Sell assigned in the past three months. The average MSFT stock price target of $469.34 implies 14.7% upside potential.

Better Buy: Microsoft or Alphabet Stock?

If I had to choose one AI stock, it’d have to be Microsoft stock despite the much higher valuation multiple. As impressive as Alphabet’s AI capabilities are, I just don’t see how it can not lose at least some market share in search. Research firm Gartner (NYSE:IT) recently predicted that traditional search engine volume will fall 25% by 2026 at the hands of AI-related entities like chatbots. There’s just too much to lose for Google.

Even if Alphabet ends up pulling ahead in the AI race, it will need to make up the difference as user dynamics shift. Personally, I’d much rather be in a disruptor like Microsoft than playing defense with a firm that may be too reliant on search.