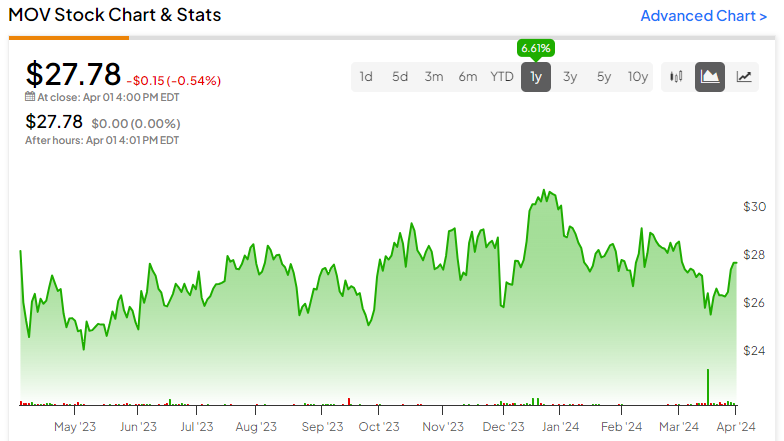

Movado Group (NYSE: MOV) has been facing challenges due to several factors including elevated interest rates and a slowdown in consumer spending on high-end products. These challenges have led to declines in both revenue and profits for MOV. Despite these obstacles, it’s worth noting that Movado’s stock is up 6% over the past year. Interestingly, the company has a reasonable valuation and pays a decent dividend, making it an attractive holding for long-term income investors.

Purveyor of Fine Watches

The Movado Group is an international watch distributor that designs and distributes watches and other accessories for a variety of brands, including Movado, Concord, Ebel, Olivia Burton, and MVMT, as well as licensed brands like Coach, Tommy Hilfiger, HUGO BOSS, Lacoste, and Calvin Klein.

Interestingly, Movado does not manufacture its own products; instead, it outsources manufacturing, sometimes even to its competitors. Their capital-light business model permits a healthy return on capital despite a relatively unlevered and cash-heavy balance sheet.

Recent Financial Results & Outlook

Movado’s fiscal 2024 performance faced headwinds due to a challenging retail environment, reducing Q4 and annual revenues last year by 7.5% and 10.5%, respectively. Compared to the prior year, the company’s Q4 net income was down by nearly half, from $23.3 million to $12.4 million, dropping EPS from $1.03 to $0.55 per diluted share. Similarly, the annual net income declined from $96.8 million to $48.3 million, with a corresponding decrease in earnings per diluted share from $4.22 in FY23 to $2.13 in FY24.

In spite of these challenges, Movado maintained a solid cash position with no debt. By the end of FY24, its cash reserves stood at $262.1 million, an increase from $251.6 million in the same period in the previous year. Furthermore, the fiscal year 2024 yielded positive cash flow from operations amounting to $76.8 million.

Although investments, such as approximately $25 million in marketing and brand-building initiatives this year, are anticipated to impact short-term profitability, the company projects these will boost market share and steer growth in the long run. For fiscal 2025, the company projects an adjusted EPS between $1.20- $1.30 and expects to generate revenues between $700M and $710M.

Is MOV a Buy, Hold, or Sell?

The recent earnings announcement has boosted the stock, and it has been up 5% in the past few trading days. It demonstrates upward price momentum, trading above its 20-day moving average of 27.23 and 50-day moving average of 27.71.

At current levels, the stock looks to be relatively cheap-to-fairly valued. The P/E ratio of 13.4x sits below the Consumer Cyclical sector average of 18.49x, though above the peer group’s average in the Luxury Goods industry at 10.89x. However, its EV/EBITDA of 5.09x sits well below that same industry’s average of 9.31x, while its Dividend Yield (5.06%) is twice the industry average.

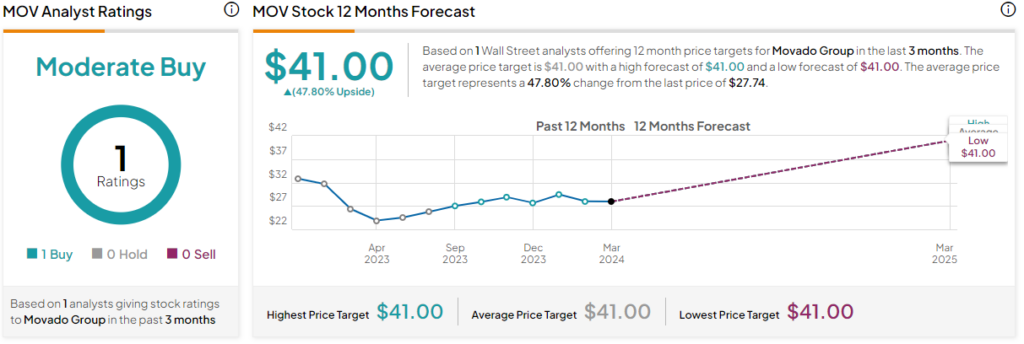

The stock is covered by one Wall Street analyst, Michael Legg of Benchmark Co. He recently reiterated a Buy rating and assigned a price target of $41. Based on his 12-month price target, TipRanks has rated the stock a Moderate Buy. The average price target for MOV of $41.00 represents a 47.80% upside from current levels.

Movado in Summary

The Movado Group recently faced headwinds in fiscal 2024 due to a challenging retail environment. However, the company managed to navigate through the downturn successfully, with its stock up in positive territory. This resilient performance, maintained against a backdrop of declining annual and quarterly revenues, underscores the company’s value proposition.

Further, its strategic investments in marketing and brand-building initiatives signal its commitment to long-term growth. Finally, the healthy dividend accentuates the attractiveness of the stock. This combination makes Movado a compelling consideration for long-term income investors.