Morgan Stanley (NYSE:MS) disclosed in a 10-Q quarter filing that it is in talks with the U.S. regulators to resolve investigations into its block trading practices. The investment bank disclosed in February that it was cooperating with the U.S. regulators over these investigations.

Morgan Stanley is currently in discussions with the Enforcement Division of the U.S. Securities and Exchange Commission (SEC) and the United States Attorney’s Office for the Southern District of New York about a potential resolution of the investigations into various aspects of its blocks business, certain related sales and trading practices as well as applicable controls. The bank cautioned that there is no assurance that the probes will be resolved.

A block trade occurs when an investor buys or sells shares in bulk quantities. Such transactions generally involve investment banks and are large enough to influence a company’s share price significantly. Regulators are reportedly investigating if Morgan Stanley’s employees used or shared information about upcoming block trades in violation of federal securities laws. In December 2022, Bloomberg reported that two Morgan Stanley executives working in its block trading division left the firm due to disagreement over cooperation in regulatory investigations.

Morgan Stanley had earlier disclosed that it also faces civil liability in connection with investor lawsuits alleging that the investment bank triggered a decline in share prices ahead of block trades.

Is Morgan Stanley a Good Stock to Buy?

Morgan Stanley is reportedly planning to lay off 3,000 employees due to continued weakness in dealmaking because of macro pressures.

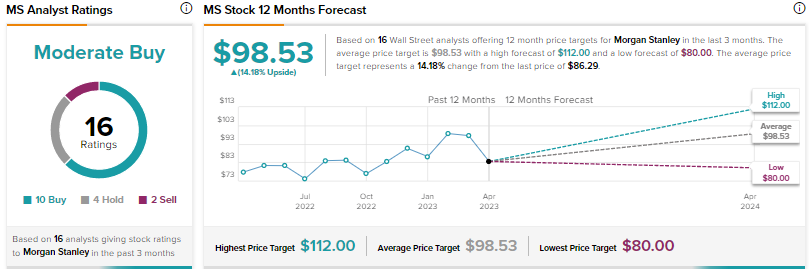

Shares have risen 1.5% so far in 2023. The average price target of $98.53 suggests 14.2% upside from current levels. Wall Street is cautiously optimistic on Morgan Stanley, with a Moderate Buy consensus rating based on 10 Buys, four Holds, and two Sells.