Most out there recognize Monster Beverage Corporation (NASDAQ:MNST), the maker of Monster energy drink, as one of the leaders in the space. It’s got its share of competitors, and it’s looking to take those competitors on with a little merger and acquisition activity. To that end, it’s working to buy Bang Energy from its bankruptcy proceedings. Investors are reasonably happy about this, as Monster closed up 0.51% in Thursday’s trading session.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The deal for Bang, so far, sees Monster Beverage putting up $362 million, based on U.S. District Bankruptcy Court filings. That includes assuming various liabilities as well as a $25 million deposit. Vital Pharmaceuticals, which makes Bang Energy, noted that such a sale would have quite a bit of support behind it. Lenders are on board, and certainly, Bang’s creditors are in as well. The Federal Trade Commission, however, is less certain and is already asking for more information ahead of such a move. It’s been making such moves with more frequency lately, which some believe is a new political stance going back as far as 2021, based on reports from Jones Day.

Monster’s woes don’t stop there, though; word from Simply Wall St. reveals that Monster is having a good run as far as return on capital employed goes. However, returns, in general, are decreasing, and that’s not much help to anyone. Those returns are down substantially from even five years ago, and that’s enough to get some investors concerned. Picking up Bang Energy might help turn things around by offering more options to the marketplace, but with discretionary income squeezed by inflation and a likely economic downturn, the end result doesn’t bode well.

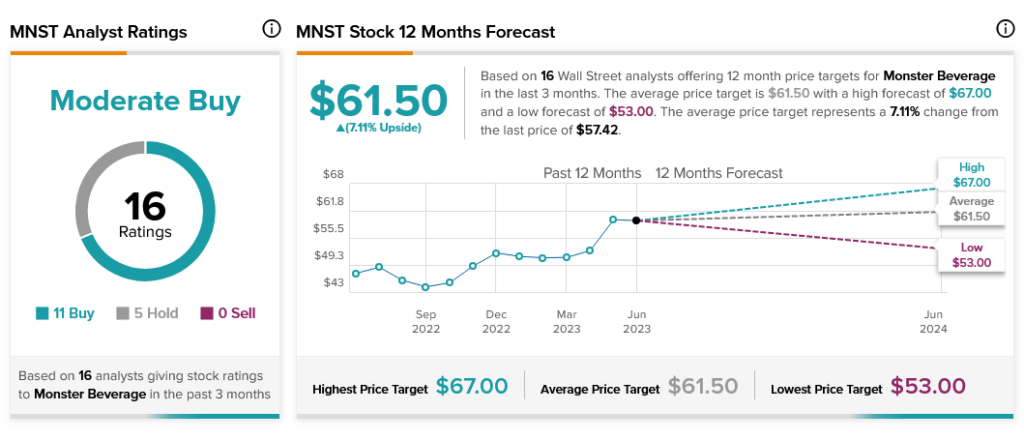

Analysts, meanwhile, are less concerned. With 11 Buy ratings and five Holds, Monster Beverage is considered a Moderate Buy. Meanwhile, it also offers 7.11% upside potential thanks to its average price target of $61.50.