Beverage stocks have been steady performers through most types of market environments, making them great names to watch as the economy runs the risk of falling into a recession. Undoubtedly, the demand for fizzy sodas or alcoholic beverages doesn’t tend to change drastically in accordance with the state of the economy. This makes these stocks great investment vehicles to give your portfolio a defensive jolt in the face of profound macro unknowns.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

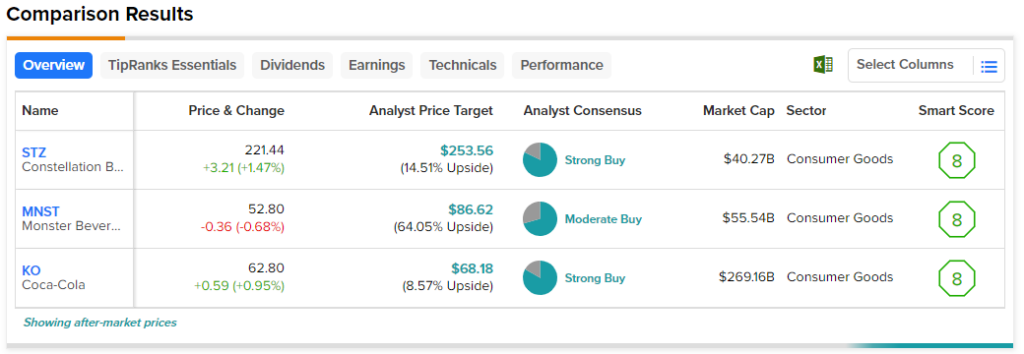

Therefore, in this piece, we’ll use TipRanks’ Comparison Tool to look at three beverage stocks analysts are bullish on.

Though stock markets are moving higher again to kick off the second quarter, it’s never a bad idea to play a bit of defense while other market participants go on the offensive.

Coca-Cola (NYSE:KO)

Coca-Cola is one of Warren Buffett‘s famous investments. He made his first investment in the company back in 1998. The investment has paid off quite handsomely for the Oracle of Omaha, as shares have made it through a few tough economic climates. Though Buffett hasn’t been adding to his stake of late, I still think the company has what it takes to deliver as the global economy moves through another one of its contractions. Sure, Coke isn’t the highest-growth company on the planet, but it is a staple for any long-term-focused portfolio that aims to do (relatively) well through good and bad times. I am bullish.

Not much has changed about the way Coke does business over the decades. It’s this degree of certainty that’s refreshing (like a bottle of Coke) during a time like this, with a recession looming and bank failures adding to investors’ nerves.

As an economic slowdown weighs (further) on spending, most people will still opt for Coke over generic colas. It’s cheap enough, even after inflation-driven price increases. The Coke brand is simply too powerful to shed market share to lower-cost rivals at the hands of modest price increases. Simply put, its pricing power has and likely will continue to remain impressive.

Looking ahead, Coke could pull many levers to improve its reach with consumers. Filippo Falorni of Citigroup (NYSE:C) started coverage on KO stock with a “Buy” rating earlier this year, citing emerging markets growth and pricing power as reasons to stay bullish on the top consumer staple.

Indeed, Coke made the most of a bad situation (the pandemic), making operational improvements amid unprecedented times, and could be in a spot to keep moving higher, even if markets take another breather through this year.

At 28.4 times trailing earnings, Coke trades in line with the non-alcoholic beverage industry average of 28.9 times. Its dividend yield of 2.97% is also a hair higher than the industry average of 2.71%. Further, given the lower beta of 0.55, KO’s valuation seems like a very fair price to pay for a steady (but wonderful) performer in turbulent times.

What is the Price Target for KO Stock?

Coke stock stands at a Strong Buy, with 10 Buys and two Holds assigned in the past three months. The average KO stock price target of $68.18 implies 8.6% upside potential in the next 12 months.

Monster Beverage (NASDAQ:MNST)

Monster Beverage stock has been steadily surging since bottoming out earlier last year. At writing, shares of the energy drink giant are up around 47% from their March 2022 low. Despite the earnings miss in Q4, investors have reasons to stay bullish, with new products coming down the pipeline and continued pricing power. I am bullish.

The Monster brand may not be as powerful as Coke. That said, I am encouraged by the firm’s ability to raise prices without shedding considerable market share.

Further, Monster is capable of sustaining double-digit EPS growth from here due to its smaller size. Coke can’t realistically grow by such a magnitude from here, given its size and dominance. With Monster’s impressive growth prospects and brand affinity, it should be no mystery as to why Coca-Cola took a 16.7% stake in the company for $2.15 billion in 2014. In many ways, Monster may very well be the Coke of energy drinks.

Over the past three years, Monster averaged a 14.5% compound annual growth rate (CAGR) regarding revenue. Looking ahead, I think Monster can keep growing its top and bottom line in the 13%-15% range, in line with its three-year growth rate. Malt beverages, unflavoured water, and wellness beverages are just some products that can help Monster keep its growth engine strong.

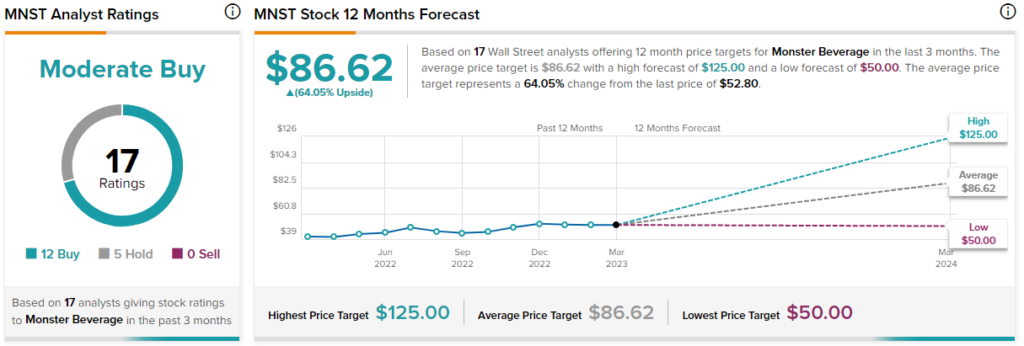

What is the Price Target for MNST Stock?

Analysts are optimistic about Monster, with a Moderate Buy consensus rating based on 12 Buys and five Holds. The average MNST stock price target of $86.62 implies 64.1% upside potential.

Constellation Brands (NYSE:STZ)

Constellation Brands is an alcoholic beverage firm that’s off around 15% from its 2022 peak. Given that alcoholic beverages are pricier than sugary sodas, Constellation hasn’t been as much of a staple as the other two beverage plays in this piece. Still, as Constellation recovers from its recent correction, I think there are reasons to be encouraged. I am bullish.

As a recession moves in, Constellation’s growth rate could hit a snag. Still, many analysts are staying with the stock. Morgan Stanley (NYSE:MS) noted that Constellation stock tends to be quick to get back on its feet after being knocked down.

With a beta of 1.01 — in line with the S&P 500 (SPX) — Constellation is a rockier ride than Coke. However, it’s one that’s still worth riding, given its strong and creative management team, which can navigate harsher economic conditions.

For instance, the company recently partnered with streamer Tastemade to improve its reach with younger audiences. I think the deal is an intriguing one that could help build long-term demand.

What is the Price Target for STZ Stock?

Constellation boasts a Strong Buy rating, with 14 Buys and three Hold ratings assigned in the past three months. The average STZ stock price target of $255.39 implies 14.5% upside potential from here.

Conclusion

Warren Buffett has stuck with top beverage play Coca-Cola for such a long time. Indeed, he’s been proven wise for doing so through the many years of booms and busts over the past. Overall, beverage stocks (including MNST and STZ) are reliable and tend to deliver boring but stable results over the long run.