Shares of Oracle (NYSE:ORCL) fell in after-hours trading after the company reported earnings for its third quarter of Fiscal Year 2023. Earnings per share came in at $1.22, which beat analysts’ consensus estimate of $1.20 per share. Sales increased by 18% year-over-year, with revenue hitting $12.4 billion. This missed analysts’ expectations of $12.42 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Oracle posted some exciting wins, even as total revenue faltered against expectations. Third quarter cloud revenue was up 45% in USD, reaching $4.1 billion. Cloud infrastructure, meanwhile, hit $1.2 billion by itself, which was up 55% in USD. Cloud application revenue hit $2.9 billion, which was up 42% with USD for a measure, and Fusion Cloud Enterprise Resource Planning (ERP) hit $0.7 billion, up a hefty 25%. Finally, NetSuite Cloud ERP hit $0.7 billion, which was up just 23% against this time last year.

In a move sure to cheer investors, the Board of Directors hiked Oracle’s dividend to $0.40, up 25% from earlier figures.

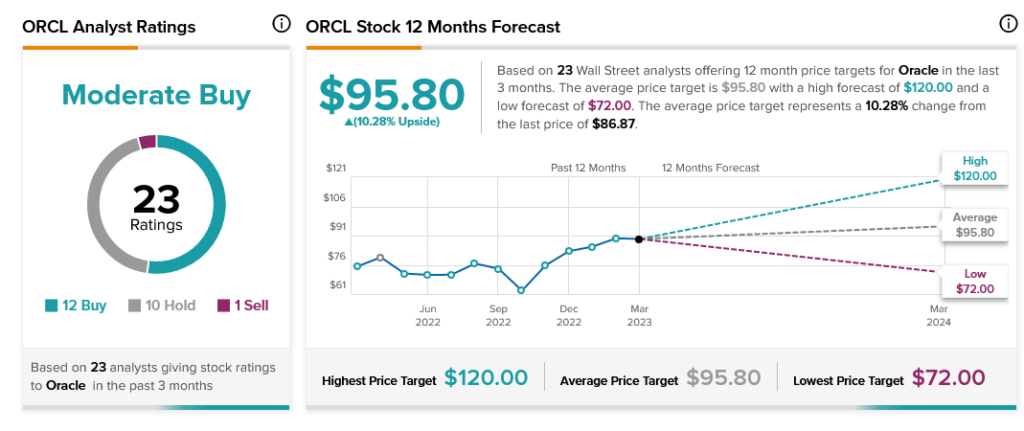

Overall, Wall Street has a consensus price target of $95.80 on Oracle, implying 10.28% upside potential, as indicated by the graphic above.