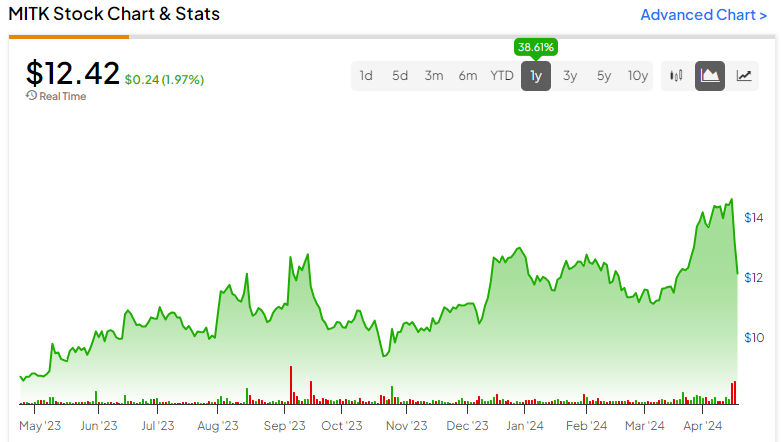

According to the Federal Trade Commission (FTC), fraud and identity theft are impacting consumers at an alarming rate. In 2022, the number of identity thefts averaged upwards of two cases per minute, affected over 40 million consumers, and cost businesses over $43 billion. The rise in sophistication of fraud and cybercrimes has become a pressing issue for businesses. Thus, companies that provide advanced digital security measures, like Mitek Systems (NASDAQ:MITK), are well-positioned for growth. MITK is up 38.6% in the past year. Yet, a recent earning miss has the stock trading at a relatively low valuation, creating a potential window for value investors.

Mitek Systems Offers Digital ID Verification Solutions

Mitek Systems is a global leader in mobile capture and digital identity verification solutions, providing services to enterprises and financial institutions. The company’s solutions facilitate the verification of user identity during digital transactions, enabling companies to meet regulatory requirements, mitigate financial risk, and drive revenue from digital channels.

Mitek has further enhanced its identity verification by utilizing machine learning and AI for document verification and incorporating biometrics. Their product range includes Mobile Deposit, Mobile Verify, Mobile Fill, Mobile Docs, A2iA CheckReader, A2iA XE, A2iA Document Reader, A2iA Text Reader, and ICAR ID_CLOUD.

Currently, over 7,500 organizations, including 99 of the top 100 banks in the U.S., have integrated Mitek’s solutions into their apps, empowering more than 80 million consumers with its capabilities. The demand for services is expected to continue growing, with estimates of the identity verification market reaching $23.9 billion by 2029 at a 15.5% CAGR.

Mitek’s Recent Financial Results & Outlook

The company recently reported financial results for the first quarter of Fiscal 2024. Total revenue of $36.9 million fell short of consensus estimates of $39.02 million and was lower than the $45.7 million revenue registered during the same period of last year. This year-on-year reduction is primarily due to a one-time multi-year mobile deposit reorder, which had pushed three years of revenue into the first quarter of last year, creating a challenging comparison.

Meanwhile, non-GAAP net income was $6.3 million, or $0.14 per diluted share, missing consensus estimates of $0.18.

Looking forward, management is projecting fiscal second-quarter revenue to range between $46 million and $47 million, surpassing the consensus estimate of $45.27 million. For the full year, the projected revenue ranges between $180.0 million and $185.0 million, reflecting a 6% growth rate at the midpoint of the range, or 12% growth after adjusting for additional license revenue recognized in Fiscal 2023 due to a unique contract term. Most of the growth is expected to occur in the second half of the fiscal year.

What Is the Price Target for Mitek Systems Stock?

Market participants reacted negatively to the most recent financial report, and the stock has shed roughly 16.75% since. However, the downward price adjustment has helped solidify the stock’s relative undervaluation, with its P/S ratio of 3.6x comparing favorably to the technology sector average of 4.3x and the software application industry average of 6.2x.

Analysts following the company have been bullish on the stock. For instance, Craig-Hallum analyst Chad Bennett recently rated the stock a Buy and assigned a price target of $19, citing expectations for sequential improvement and year-over-year growth accelerating in the second half of the year.

Mitek Systems is rated a Strong Buy based on the recommendations and 12-month price targets five Wall Street analysts assigned in the past three months. The average price target for MITK stock is $19.25, which represents 51.8% upside potential from current levels.

Final Analysis on MITK Stock

In an era where identity thefts and cybercrimes are quickly increasing, Mitek Systems is poised to meet this surging demand and deliver advanced technology and services. Despite recent financial results that missed consensus estimates, expectations for more robust performance in the second half of the year point to future growth. The company’s stock trades at a relatively low valuation, making Mitek a compelling option for value investors searching for a small-cap tech stock with long-term potential.