Microsoft’s (NASDAQ:MSFT) gaming efforts haven’t always borne fruit. It’s been pretty much second place for the last two console generations now, coming in behind Sony (NYSE:SONY) regularly. But the idea that Microsoft may be looking to get out altogether might not have crossed many minds. That may be what’s going on right now, according to former head of Xbox Peter Moore. That news wasn’t welcome for investors, though, who sent Microsoft down fractionally in the closing minutes of Monday afternoon’s trading.

Moore’s background gives him some room to understand what’s going on. While he hasn’t been with Microsoft since the Xbox 360 three generations ago, there’s still at least some room for understanding. Moore also served as president of Sega America for a while, giving him insight into the time when Sega bowed out of the console wars with its ill-fated Dreamcast.

What Moore had to say in a recent interview with IGN should give any gamer pause. Moore points to stagnant growth rates; very few truly new gamers are making the jump to consoles. And while the market is still substantial, there’s not much changing the pie from one generation to another. Plus, with gaming changing faces, from physical media to cloud-based systems, is there even a reason to have a devoted box any more?

A Potential Backlash

Here’s where the problems begin, and they don’t even begin with Microsoft. They actually begin with Sony, who has been increasingly demonstrating to its customers why physical media is likely a good idea. As 2023 came to an end, Sony delivered a bombshell to its customers: due to “content licensing agreements,” those customers who had already purchased content from Discovery (now Warner Bros. Discovery (NASDAQ:WBD)) would no longer be able to view that content.

Immediately after, Sony locked several customers out of its PlayStation marketplace. Games or services that were already purchased were left inaccessible. And that, in turn, left a growing body of consumers very concerned about the whole concept of digital downloads. It’s a lesson that Microsoft may well want to learn if that’s the route it’s looking to go.

Is Microsoft Stock a Buy, Sell, or Hold?

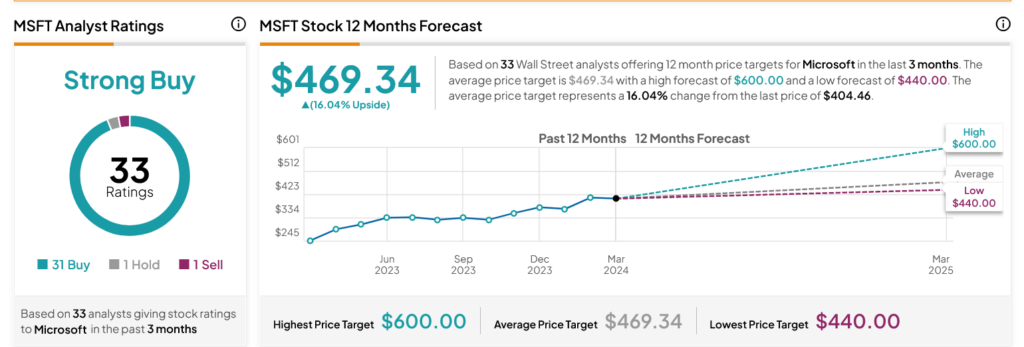

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 31 Buys, one Hold, and one Sell assigned in the past three months, as indicated by the graphic below. After a 60.79% rally in its share price over the past year, the average MSFT price target of $469.34 per share implies 16.04% upside potential.