Starting April 1—and you could be forgiven for thinking this was some kind of April Fool’s joke in the making—tech giant Microsoft (NASDAQ:MSFT) has a new plan for pricing when it comes to security tools. Investors, meanwhile, are slightly impressed, and gave Microsoft stock a fractional boost in Wednesday afternoon’s trading.

Microsoft has made several significant advances in the field of artificial intelligence (AI), and its latest move depends somewhat on those achievements. Microsoft is turning to a “consumption-based model” for pricing on its new tools, charging $4 per each “security compute unit,” as Microsoft reps describe it.

The compute units, in turn, will be used to pay for services accordingly based on usage. After all, Microsoft notes, each individual user may have many different demands, and going to a per-unit pricing system allows for maximum flexibility, even from one month to the next.

Threats Are on the Rise

Security has always been big business for Microsoft; it represented about $20 billion in revenue for Microsoft just in 2022. And with signs that entire countries are getting involved in cyberattacks, that makes improving security around network connections and the like only more valuable. While Microsoft’s new pricing model might seem unnecessarily convoluted, there is something to be said for flexibility in pricing.

That’s especially true in challenging macroeconomic conditions, like the kind we’re seeing now. In fact, Microsoft might well pull more business as a result of those businesses looking to thread the needle in augmenting security while still watching the budget, buying only that which they need at the time.

What Is Microsoft’s Price Target?

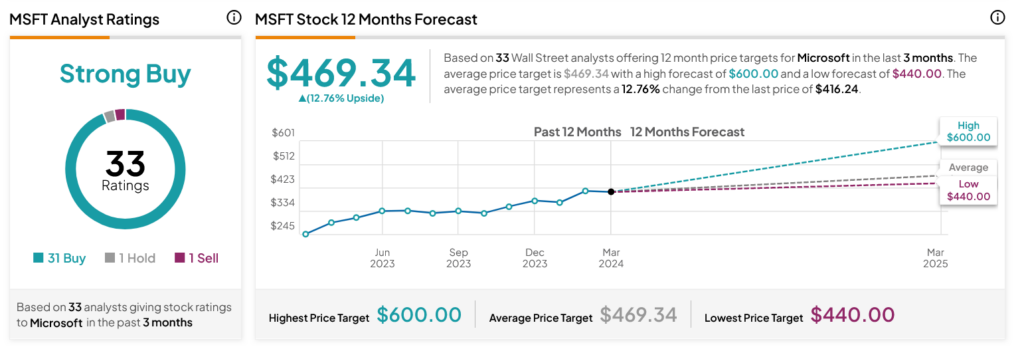

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 31 Buys, one Hold, and one Sell assigned in the past three months, as indicated by the graphic below. After a 60.71% rally in its share price over the past year, the average MSFT price target of $469.34 per share implies 12.76% upside potential.