Technology giant Microsoft (NASDAQ:MSFT) may have been exploiting social media platform Twitter’s application programming interface (API), as per a letter written by the latter’s ex-chief executive, Elon Musk. In a letter dated May 18, Musk alleged that Microsoft is using Twitter’s API to enhance its tools, namely Xbox, Bing, and other advertising programs. What’s worse, Microsoft has denied paying the usage charges when demanded last month.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Alex Spiro, the lawyer who represents Musk in the letter, stated, “Microsoft may have been in violation of multiple provisions of the agreement for an extended period of time.” The letter also demands that Microsoft submit all information related to the use of Twitter’s API in the past two years. Plus, Musk wants to know which of Twitter’s content is currently in Microsoft’s possession. Microsoft’s spokesperson confirmed the receipt of the letter and stated that the firm would reply after careful deliberation.

Since Twitter’s takeover, Musk has tried to boost its revenue through various means, including increasing prices for accessing its APIs and charging a fee for verifying accounts on Twitter.

Both Microsoft and Twitter have enjoyed a long-standing relationship, wherein Microsoft has continued to use Twitter’s standard developer APIs for free in some of its products. However, recently, Musk has taken a bitter-sweet approach towards Microsoft and has often swung accusations at the tech firm via tweets. Musk is especially enraged by Microsoft’s investment in and dependence on OpenAI’s ChatGPT software. Musk and other AI experts disagree with the speed of AI development and the potential outcomes.

Is Microsoft a Buy, Sell, or Hold?

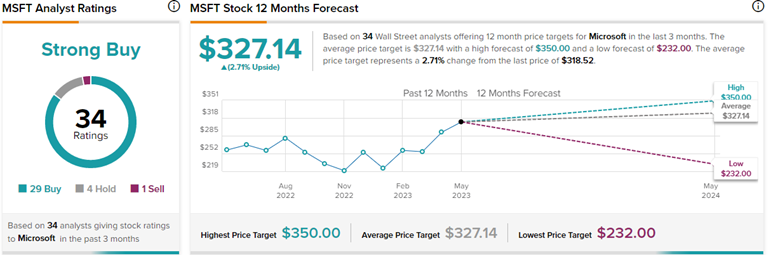

Wall Street is certainly bullish about MSFT’s future trajectory. On TipRanks, Microsoft commands a Strong Buy consensus rating based on 29 Buys, four Holds, and one Sell. Also, the average Microsoft price forecast of $327.14 implies 2.7% upside potential from current levels. Meanwhile, MSFT stock has gained 33.3% so far this year.