Tech giant Microsoft (NASDAQ:MSFT) put quite a bit of cash behind OpenAI, which isn’t an AI stock yet. If it were, however, it would likely be doing pretty well right now as new numbers have emerged, spelling out the impressive performance seen so far.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The most recent word suggests that OpenAI has already managed to achieve a revenue run rate of $1 billion. That’s an impressive milestone for any operation, and it even blows OpenAI’s own revenue projections out of the water. Currently, it’s in range of passing $80 million per month in revenue, and before it started charging for the ChatGPT chatbot, it was only pulling in about a third of that at $28 million. Now, thanks to the new pricing scheme, it’s offering subscriptions at $20 per month, and between one million and two million subscribers have already stepped in.

That’s not the only connection Microsoft made recently, though; Microsoft also started up a new agreement with Synthetaic, providing cloud computing tools to advance Synthetaic’s work of analyzing data from air sensors as well as space-based sensors. If the name sounds familiar, then you may remember the Chinese spy balloon back in the early days of 2023. Synthetaic managed to track the balloon with its sensor array before the balloon was ultimately shot down. Microsoft’s contribution, meanwhile, should help demonstrate how much data it can handle and, thus, how useful it can be to other businesses.

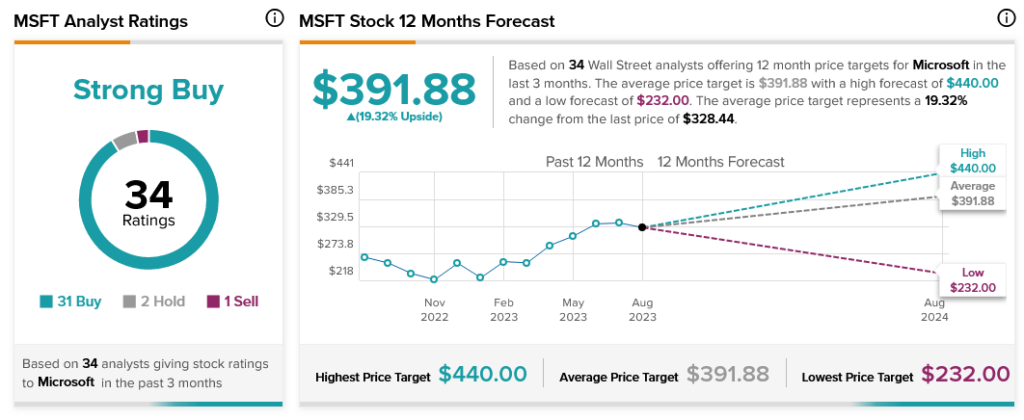

Not that Microsoft needed much help proving its usefulness as far as analysts were concerned. With 31 Buy ratings, two Holds and one Sell, Microsoft stock is considered a Strong Buy by analysts. Further, Microsoft stock offers investors 19.33% upside potential thanks to its average price target of $391.88.