OpenAI has launched ChatGPT Enterprise, the business version of its AI (Artificial Intelligence) chatbot. The product may rival Microsoft’s (NASDAQ:MSFT) Bing Chat Enterprise, which was introduced in July. While it is too early to judge how ChatGPT Enterprise will fare against Microsoft’s offering, the increasing competition in this space is likely to pose future challenges for the tech giant.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Returning to ChatGPT Enterprise, OpenAI said businesses will have unlimited access to GPT-4 (its most powerful version of ChatGPT yet) and advanced data analysis. In addition, the new enterprise version will be up to two times faster than its current ChatGPT offering.

Moreover, to alleviate data protection and privacy concerns, OpenAI said it will offer enterprise-grade privacy, security, and deployment tools. The company highlighted that, similar to Microsoft’s Bing Chat Enterprise, it will not utilize customer data for training its models. The goal of this strategy is to guarantee users’ data safety.

Microsoft owns a significant stake in OpenAI (about 49%), and Bing is the default search experience for OpenAI’s ChatGPT. However, both companies operate separately, and the success of their enterprise offerings will depend on the use case, features, data protection, and privacy. Against this backdrop, let’s look at what the Street recommends for Microsoft stock.

Is Microsoft Stock a Good Buy Right Now?

Microsoft stock has gained nearly 36% year-to-date as investors cheered the integration of AI into its products and services. Meanwhile, the expected reacceleration in the Cloud business will positively impact its financials. The company continues to invest in cloud and AI infrastructure and is poised to lead the AI platform wave. Further, it will likely benefit from the cost-saving measures and operating leverage.

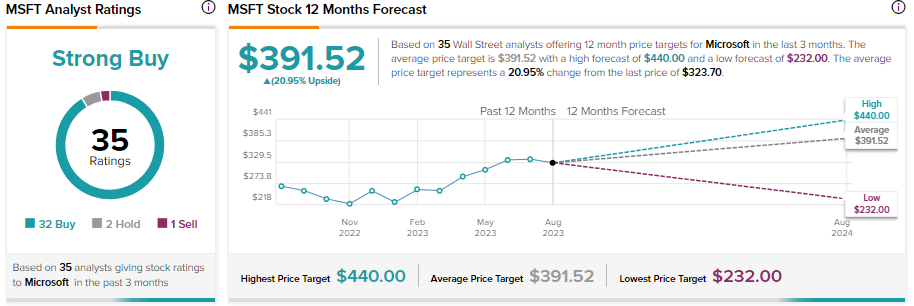

All these positives keep Wall Street analysts bullish about its prospects. Microsoft stock sports a Strong Buy consensus rating on TipRanks based on 32 Buy, two Hold, and one Sell recommendations. Analysts’ average price target of $391.52 implies 20.95% upside potential from current levels.