U.S. tech giant Microsoft (MSFT) is not relenting in its effort to boost its cloud computing power. The company has made a new arrangement to rent such capacity from Nscale, the British cloud computing startup that recently raised a historic $1.1 billion from its series B funding round.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The capacity will come from Nscale’s data center facility in Portugal, according to Bloomberg, citing insider sources. The facility is based in Start Campus in Sines, a coastal town in Southern Portugal. The campus is majority-owned by investment companies Davidson Kempner and Pioneer Point Partners.

The data center is expected to be built using Nvidia’s (NVDA) Blackwell Ultra GB300 graphics processing units (GPUs) and is expected to be ready for operation early next year.

Microsoft Expands Partnership with Nscale

Microsoft’s new arrangement with Nscale builds on its existing partnership with the British company which was previously a bitcoin mining firm until it spun off from Akron Energy last year.

Microsoft had previously signed a $6.2 billion deal with Nscale to secure access to high-performance AI infrastructure in Narvik, Norway. The U.S. tech giant also recently teamed up with the British firm to build the UK’s largest supercomputer as part of its $30 billion investment in the country.

The project is the UK outpost for the U.S.-birthed Stargate project, a massive $500 billion AI data center infrastructure initiative spearheaded by OpenAI (PC:OPAIQ) and other U.S. tech majors.

Neocloud Firms Enjoy Big Tech Patronage

Nscale is one of several neocloud providers such as Nebius (NBIS), CoreWeave (CRWV), and IREN Limited (IREN) that have arisen to meet the computing capacity needed by Big Tech companies.

Technology firms are racing to be at the frontier of artificial intelligence innovation, and neocloud firms focus on providing them with the GPU infrastructure required for massive AI and machine learning workloads.

Is Microsoft a Buy or Sell Right Now?

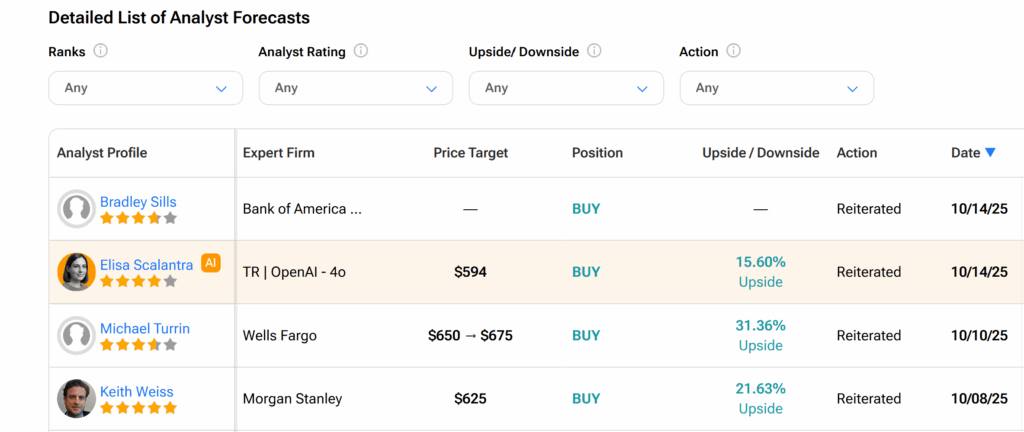

Turning to Wall Street, Microsoft’s shares currently boast a Strong Buy consensus rating, as seen on TipRanks. This is based on 34 Buys and one Hold assigned by 35 Wall Street analysts over the past three months.

Furthermore, the average MSFT price target of $628.05 suggests a 22% upside potential from the current level.