Two five-star analysts on Tuesday raised by more than 100% their price targets on data center infrastructure company IREN Limited’s (IREN) shares, defying Wall Street’s generally tempered approach to the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

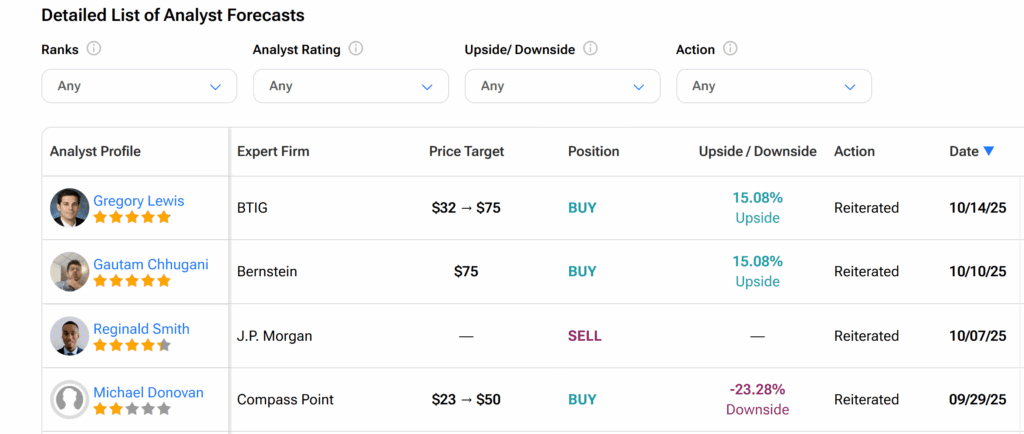

Cantor Fitzgerald analyst Brett Knoblauch raised his price target from $49 to $100 per share, representing a 104% boost. BTIG Gregory Lewis went even further with a 134% increase– he elevated his price target to $75 per share, up from $32.

The former maintained his Overweight rating on IREN stock, while the latter also stuck to his Buy recommendation. Both five-star analysts attributed the elevation to IREN’s market positioning to meet the energy demand for massive AI workloads.

Knoblauch even noted that IREN has what it takes “to become one of the biggest providers of compute in the world.”

IREN Ramping Up Cloud Business, Analyst Says

According to Knoblauch, IREN has “heavily leaned into” its AI cloud business over the past months, making the company previously focused on bitcoin mining closer more similar to data center operator CoreWeave (CRWV).

Knoblauch believes that IREN has “more room to run”, even as its stock has been riding market momentum amid expectations that the company will redirect its focus entirely to its graphics processing unit (GPU) cloud business.

IREN, which was recently admitted into Nvidia’s (NVDA) Preferred Partner Program, is even preparing to receive 9,000 Blackwell GPUs from the chip design colossus.

Does IREN Trade at a 75% Discount?

The analyst believes that IREN is currently trading at about 75% discount when compared to its neocloud peers on the amount of megawatts power capacity secured via contracts. Neocloud firms — unlike traditional cloud giants such as Microsoft Azure (MSFT), Google Cloud (GOOGL), and Amazon Web Services (AMZN) — focus on providing GPU infrastructure tailored for AI and machine learning workloads.

“While we argue it should trade at a discount today given revenue backlog disparity, we see that gap closing over time, resulting in a material re-rating in IREN shares,” Knoblauch explained.

Is IREN Stock a Strong Buy?

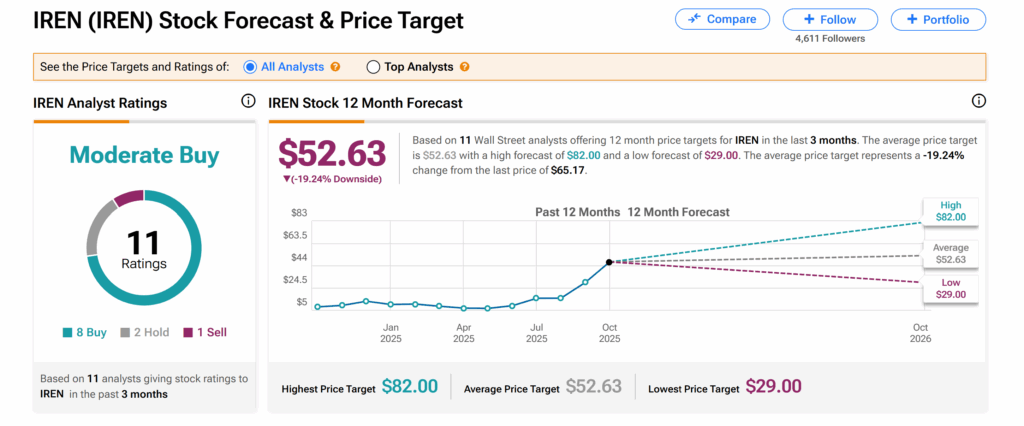

Across Wall Street, optimism in IREN stock is much more cautious, with the shares holding a Moderate Buy consensus rating, as seen on TipRanks. This is based on eight Buys, two Holds, and one Sell rating assigned by 11 Wall Street analysts over the past three months.

Moreover, the average IREN price target of $52.63 indicates a 19% downside risk from the current level.