Micron Technology’s (MU) shares took a beating on Wednesday afternoon despite the memory chipmaker reporting solid Q4 2025 results after the closing bell a day earlier. The results topped Wall Street expectations and earned price boosts from analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, as of 1:50 p.m. EDT, MU stock was down almost 4% to about $160 per share.

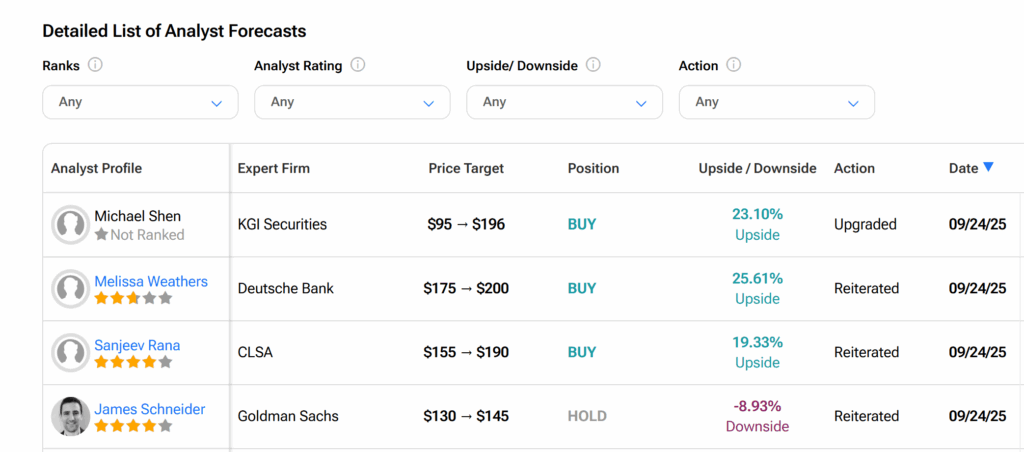

This came as the stock reversed earlier gains made during early trading on Wednesday morning when investors cheered its stronger-than-expected performance. Deutsche Bank (DB) analyst Melissa Weathers, joining other commentators in hailing the performance, said Micron “cleared a very high bar.”

Micron manufactures a range of memory chips, including High Bandwidth Memory (HBM) and Dynamic Random Access Memory (DRAM). HBM is an ultra-fast, layered memory that boosts performance for AI and big data tasks. Similarly, DRAM temporarily stores data to help computers and servers run efficiently and multitask seamlessly. Both are crucial for AI, gaming, and cloud computing.

Analysts Dissect Micron’s Performance

Micron, in its latest financial results, reported a 46% jump in sales from the same period last year. The company’s stock climbed as much as 5% in extended trading on Tuesday after the results were revealed.

The American manufacturer, which also designs computer data storage technologies, saw its revenue hit $11.3 billion, exceeding analysts’ forecast of $11.2 billion. Earnings per share also came in at $3.03, beating Wall Street’s $2.86.

Commenting on the performance, Micron CEO Sanjay Mehrotra noted the company “is uniquely positioned to capitalize on the AI opportunity ahead.” Wall Street analysts have also swung into action, dissecting the Idaho-based company’s latest performance.

While Bank of America Securities’ (BAC) Vivek Arya attributed the performance to the “dual-drivers” of fast-growing AI demand and supply in the memory chip industry, Barclays’ (BARC) analyst Thomas O’Malley pointed to Micron’s “more aggressive” HBM strategy, with extra benefits from rising prices of embedded solid-state drives (SSDs). SSDs are storage chips built directly into a device’s motherboard.

‘The Star of the Show’

Meanwhile, Micron in the recent quarter reported a gross margin of 45.7%, meaning that the company keeps 45.7 cents from every $1 in sales after covering direct costs like materials and labor. In her reaction, Deutsche Bank’s Melissa Weathers, who raised her price target for MU stock to a “conservative” $200—suggesting a 14% upside potential—praised Micron’s “stellar” gross margin as “the star of the show”.

Weathers expects Micron to maintain its margin performance and its HBM market share into next year. She sees the company piggybacking on factors such as the sustenance of its low operating costs and a relatively tighter supply environment that will drive up prices.

On the other hand, BofA’s Arya is concerned that Samsung (SSNLF) entering the HBM market could pressure Micron’s market share. However, Weathers noted that while pricing talks for 2026 are still ongoing, she expects HBM prices would not impact Micron as much as investors fear.

Is Micron a Good Buy Right Now?

Across Wall Street, Micron’s shares have a Strong Buy consensus recommendation based on 23 Buys and three Holds assigned by 26 Wall Street analysts over the past three months. Moreover, the average MU price target of $190.81 suggests a 20% growth potential from the current level.