The stock of Micron Technology (MU) was up as much as 5% after the data storage company reported financial results that beat Wall Street forecasts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

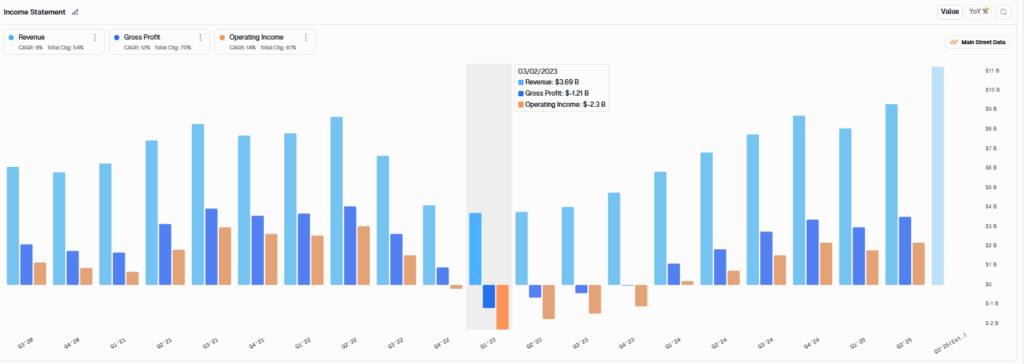

For what was its Fiscal fourth quarter, Micron announced earnings per share (EPS) of $3.03, which topped the $2.86 consensus expectation of analysts. Revenue in the period totaled $11.3 billion, surpassing forecasts of $11.2 billion. Sales were up 46% from a year earlier.

Micron also reported a gross margin of 45.7%, which came out ahead of estimates of 44.3%. In terms of guidance, Micron said that it expects earnings in the current quarter of $3.75 a share, which beat the consensus on Wall Street that called for a profit of $3.05. Revenue is forecast to come in at $12.5 billion, which topped estimates of $11.9 billion.

Micron’s income statement. Source: Main Street Data

AI Opportunity

“As the only US-based memory manufacturer, Micron is uniquely positioned to capitalize on the AI opportunity ahead,” said Sanjay Mehrotra, the company’s CEO, in the earnings release. Micron’s memory chips and data storage technologies are widely used in artificial intelligence (AI) data centers.

Owing to strong data center demand, Micron took the unusual step of raising its Fiscal fourth-quarter guidance in August of this year from what it had been only two months earlier. Management at the company has said that they are racing to keep up with demand for Micron’s products. MU stock has nearly doubled in 2025, having risen 98% on the year.

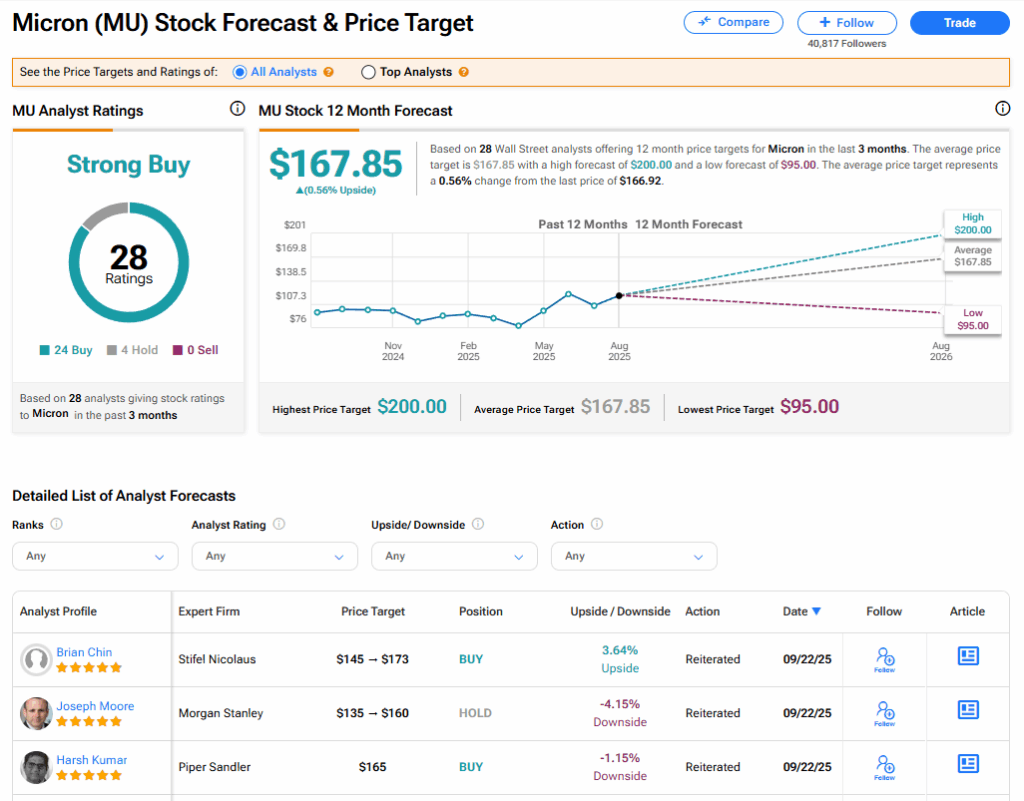

Is MU Stock a Buy?

Micron’s stock has a consensus Strong Buy rating among 28 Wall Street analysts. That rating is based on 24 Buy and four Hold recommendations issued in the last three months. The average MU price target of $167.85 implies 0.56% upside from current levels. These ratings are likely to change after the company’s financial results.