Earlier today, Micron (NASDAQ:MU) was part of a general decline in the chip stock sector that included other big names like Intel (NASDAQ:INTC) and Applied Materials (NASDAQ:AMAT). But Micron is bouncing back from today’s low, though it’s still down against its closing figures on Friday. What brought it back? A little reconsideration of the potential impact of a Chinese ban on Micron products.

The Cyberspace Administration of China effectively banned large portions of its major infrastructure operations from buying Micron chips. Micron, in turn, offered a projection that this would do damage, but damage in the “low-single to high-single-digit percentage” range. The Chinese issued the ban, noting that Micron chips represented a cybersecurity risk. Micron, for its part, was puzzled by the development, noting that it’s provided services for the last 20 years without incident.

This was a projection that Bernstein analyst Mark Li agreed with, for the most part. Bernstein noted that the worst-case scenario was a loss of 11%, and that case was actually unlikely. The more likely case, Li asserted, was a loss in the “low single digits.” Better yet, for investors, the losses would likely prove temporary. After all, Li pointed out that 20% of Micron’s revenue came from enterprise and cloud server operations. If that’s what China meant by “critical information infrastructure operators,” then Micron’s losses will be much less pronounced.

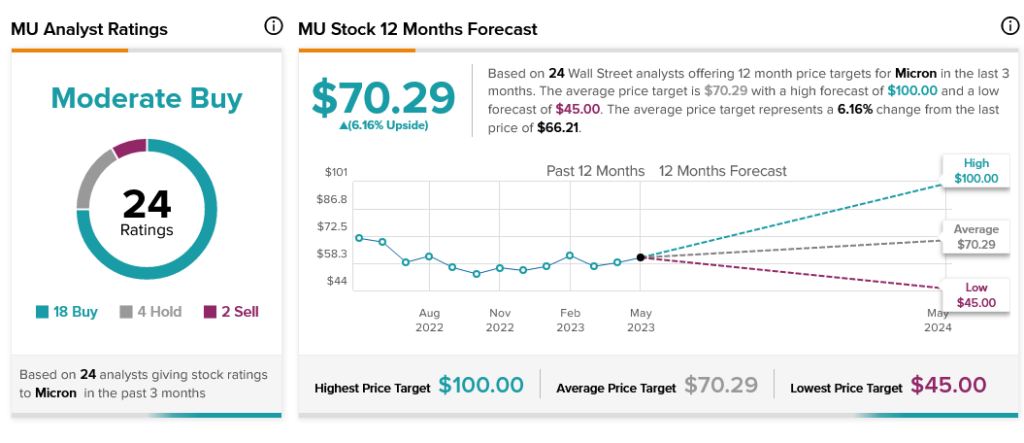

Analysts are, by and large, on Micron’s side here. With 18 Buys, four Hold, and two Sell ratings, Micron stock is considered a Moderate Buy by analyst consensus. However, with an average price target of $70.29, Micron can only offer slight upside potential as its current share price is close to the target.