Shares of UK-based software company Micro Focus (GB:MCRO) jumped by almost 94% in the wake of takeover news by a Canadian software company, Open Text Corp. (Nasdaq:OTEX).

Micro Focus is one of the few remaining London-listed technology companies, and the deal is the latest in a series where British tech firms have been bought by overseas interests.

OpenText will acquire the entire share capital at 532p per share. OpenText, a leading provider of cloud-based information management solutions, reported that this is their largest acquisition to date.

Greg Lock, chairman of Micro Focus, said, “The premium offered demonstrates the significant progress we have made in transforming the business.”

In the last few years, Micro Focus has been struggling to maintain its profitability with declining revenues. In its interim results for 2022, the company reported a 6.8% decline in its revenue to $1.3 billion. The company is targeting flat or slightly better revenue growth by 2023.

Stephanie Price, the analyst from CIBC, commented on the deal, “We expect Micro Focus to be a multiyear turnaround story. We see upside if Open Text is able to turn the Micro Focus business around faster than expected.”

What does Micro Focus International PLC do?

Micro Focus is a UK-based IT company that provides software and consultancy services to Fortune Global 500 companies, helping companies to strengthen and run their operations smoothly.

The company’s services include cloud solutions, IT transformation, modernising core applications and strengthening cyber security, etc.

Micro Focus stock forecast

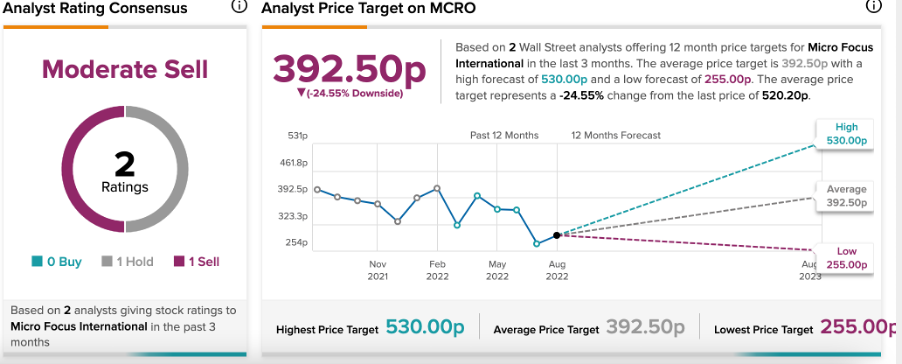

Prior to the deal, according to TipRanks’ analyst rating consensus, Micro Focus stock had a Moderate Sell rating based on one Sell and one Hold recommendation.

The MCRO target price was 392.5p, with analyst price targets ranging from a low of 255p to a high of 530p.

Conclusion

The deal is expected to close in the first quarter of 2023 and will help both companies enhance their software offerings and serve a larger market.