Casino resorts’ operator MGM Resorts (NYSE:MGM) shares rose 2.5% in extended trade yesterday after posting a solid third quarter Fiscal 2023 beat. Additionally, the board of directors authorized a new share buyback plan of $2 billion while repurchasing shares worth $572 million during the quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Adjusted earnings of $0.64 per share significantly surpassed analysts’ estimates of $0.52 per share. In the prior-year quarter, MGM reported an adjusted loss of $1.39 per share. Similarly, revenues of $3.97 billion grew 16% year-over-year and exceeded the consensus of $3.86 billion.

MGM’s Q3 was marred by the cyberattack in September, which halted operations for a few days, impacting top-line numbers. Also, the sale of The Mirage and Gold Strike Tunica negatively impacted revenue growth during Q3. On the brighter side, a recovery and a jump in visitations to MGM China helped boost revenues. Year-to-date, MGM stock has gained 16.1%.

Is MGM a Buy, Sell, or Hold?

Impressed by the Q3 print and prospects of improved future performance, Deutsche Bank analyst Carlo Santarelli reiterated a Buy rating on MGM. The five-star analyst noted that MGM’s fundamentals are robust and the outlook remains promising. Santarelli has a price target of $50 (29.4% upside) on the stock.

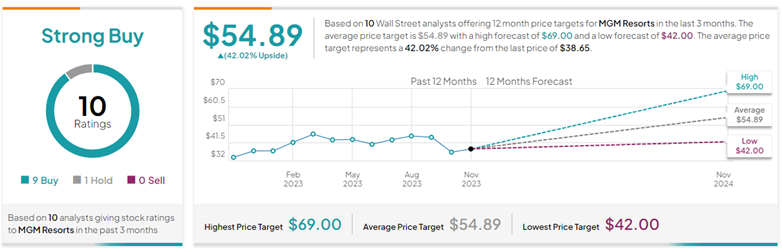

Overall, with nine Buys versus one Hold rating, MGM has a Strong Buy consensus rating on TipRanks. Also, the average MGM Resorts price forecast of $54.89 implies 42% upside potential from current levels.