MGM Resorts International (NYSE:MGM), a leading operator of casino resorts and part of the S&P 500 Index (SPX), can be considered an attractive stock with solid long-term potential, as per Wall Street analysts.

MGM is a global gaming and entertainment company operating in Las Vegas, Massachusetts, New Jersey, and other U.S. destinations, and internationally in China and Japan. Moreover, MGM’s 50/50 venture, BetMGM, provides U.S. sports betting and online gaming through brands, including BetMGM and PartyPoker.

MGM Resorts ranks well on TipRanks tools, with a Smart Score of nine implying that the stock is likely to outperform market expectations. Plus, it has a Bullish Blogger Sentiment and a Positive Hedge Fund Confidence Signal. Even the “Big Short” investor, Michael Burry has bought shares of MGM Resorts considering its long-term value proposition.

Here’s Why MGM Resorts is a Lucrative Bet

MGM is already a well-established player in the casino and leisure resorts market worldwide. Mainly, it’s the BetMGM story that attracts investors to the company. Several states across the U.S. have legalized retail and online sports betting and casino gaming. BetMGM has a presence in 28 states through different channels offering either Mobile, Retail, or Mobile and Retail offerings. Moreover, BetMGM is focused on increasing its presence as online wagering becomes legalized in additional states and adoption grows.

For the full year of Fiscal 2023, MGM’s Las Vegas Strip Resorts and MGM China delivered record-high adjusted property EBITDAR (earnings before interest, tax, depreciation, amortization, and restructuring). Also, the company generated adjusted earnings of $2.67 per share, turning from a loss of $2.73 in Fiscal 2022, driven by a 23% jump in net revenue. Moreover, BetMGM hit the upper end of the revenue target range of $1.8 billion to $2.0 billion and achieved positive EBITDA.

Furthermore, the company rewarded shareholders with massive share buybacks. MGM repurchased 54 million shares for $2.3 billion in 2023 and bought an additional 6 million shares as of February 13, 2024.

Is MGM a Good Stock to Buy?

On March 25, research firm Mizuho Securities initiated coverage of MGM stock with a Buy rating and price target of $61 (36.9% upside). The firm is encouraged by MGM’s large domestic and international presence in the casino and online gaming markets. It believes that parts of MGM’s businesses remain undervalued, while the company has the potential to generate solid free cash flows and buyback additional shares.

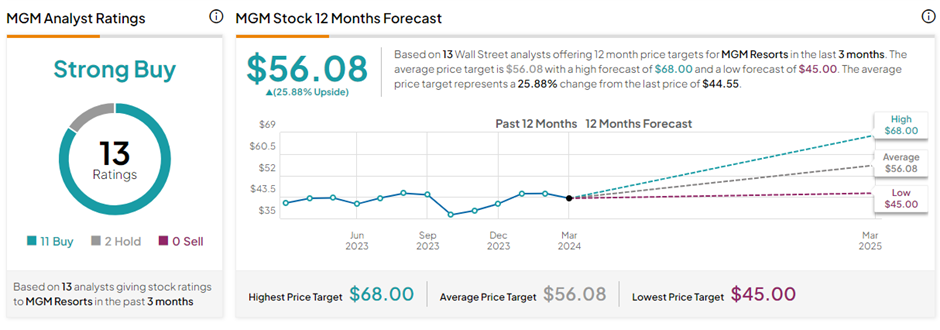

Overall, with 11 Buys and two Hold ratings, MGM stock has a Strong Buy consensus rating on TipRanks. The average MGM Resorts International price target of $56.08 implies 25.9% upside potential from current levels. In the past year, MGM shares have gained 6.8%.

Key Takeaways

MGM Resorts is witnessing a reversal of fortunes after the pandemic put a literal halt to its operations. The casino and resort operator is benefiting hugely from the pent-up demand in travel and leisure tourism, especially after the reopening of the Chinese economy. Meanwhile, the sports betting and iGaming industry is expected to receive a boost as more and more states legalize the segment, boosting BetMGM’s prospects. Overall, analysts remain highly bullish about the long-term trajectory of MGM stock.