After a stellar initial success, Mark Zuckerberg’s Twitter (now X) rival, Threads, witnessed a plunge in usage. As users’ excitement fades for Threads, Meta Platforms (NASDAQ:META) plans to launch its web version to increase its popularity. It remains to be seen whether a web version will be able to bring users back, but the company is still committed to the long-term success of the microblogging social network through improved retention and growing scale.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It’s worth highlighting that Threads saw unprecedented growth with its launch. Meta’s threads outperformed OpenAI’s ChatGPT in terms of popularity, achieving 100 million sign-ups in just five days. Nevertheless, the usage of Threads has dropped since then.

According to Similarweb (NYSE:SMWB), a digital data and analytics company, the Android version of the Threads app peaked at 49.3 million daily active users worldwide on July 7. However, it dropped to 10.3 million daily active users on August 7. In addition, the time spent on the app dropped drastically.

Besides for the web version, Meta is also focused on improving the search feature of Threads. As Threads is still very new, it remains a wait-and-see story of how the microblogging social network will evolve in the coming days. Meanwhile, let’s look at what the Street recommends for Meta Platforms.

Is META a Good Stock to Buy?

Meta Platforms has been hitting all the right chords in 2023. The company is witnessing solid user engagement growth across its family of apps. Moreover, it benefits from the reacceleration in ad revenues, investments in AI (artificial intelligence), and a focus on reducing costs and driving profitability.

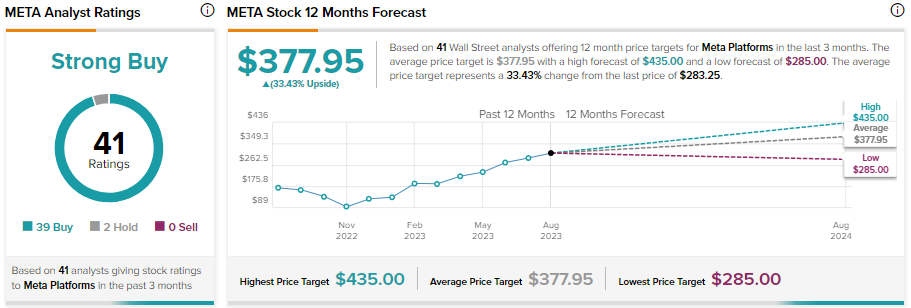

These are positive developments for Meta, keeping Wall Street analysts bullish about its prospects. With 39 Buy and two Hold recommendations, Meta stock sports a Strong Buy consensus rating. Analysts’ average 12-month price target of $377.95 implies 33.43% upside potential from current levels.