Tech giants like Alphabet (NASDAQ:GOOGL)(NASDAQ:GOOG) and Meta Platforms (NASDAQ:META) are laser-focused on driving profitability as they increase investments in AI (artificial intelligence). These companies are trimming costs in businesses and projects that have yet to achieve commercial success and are taking a toll on their margins.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Recently, a Wall Street Journal report highlighted that Verily Life Sciences, a unit of Alphabet and part of its Other Bets segment, is planning for additional cost cuts. The move comes as Google is aggressively lowering its expenses to cushion earnings and investing heavily in AI.

Verily is a health technology company that has seen its losses widen in the first half of 2023. The report highlighted that Verily has already taken steps like removing employees and discontinuing some products to lower expenses.

Alphabet came under fire in November last year when TCI Fund Management, a significant shareholder in the company, raised concerns about its costs. TCI recommended Alphabet substantially reduce losses in its Other Bets (combination of multiple businesses that are not individually material) segment and increase share buybacks. Notably, the division delivered an operating loss of $5.3 billion and $6.1 billion in 2021 and 2022, respectively.

While Alphabet is lowering costs in its Other Bets segment, Meta is reducing expenses in businesses that do not generate revenues. Let’s delve deeper.

Meta Dissolved ESMFold Project

Earlier, Meta was in the news for dissolving the ESMFold group, which used AI to predict protein structures. However, the segment generated no revenue.

The move was part of the company’s restructuring initiatives to reduce costs. The ESMFold group was part of Meta’s purely scientific projects, or Blue Sky projects (including research where real-world application and commercial benefits are not known).

Like GOOGL, Meta has significantly reduced its employees to lower expenses and generate sustainable profit in the future.

As these tech giants are lowering their expenses, let’s look at what the Street analysts recommend for these stocks.

Is GOOGL Stock Expected to Go Up?

GOOGL is expected to benefit from the acceleration of Search advertising revenue growth. Also, the stabilization in advertiser spending augurs well for growth. Further, the momentum in its Cloud business, customers’ growing interest in its AI-optimized infrastructure, and its focus on lowering costs will support its financials.

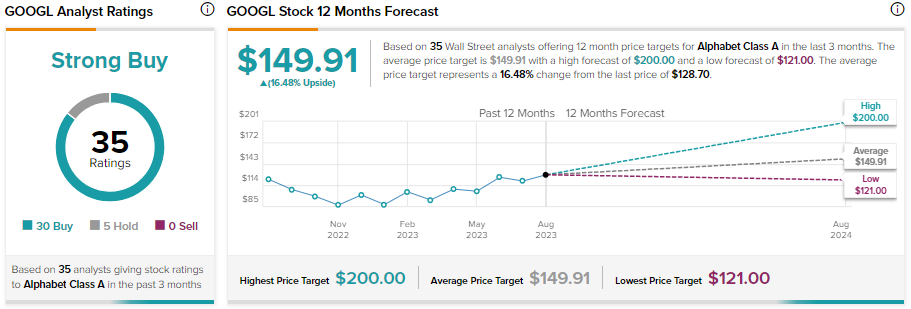

These are positive developments for Alphabet, keeping Wall Street analysts bullish about its stock. Alphabet stock sports a Strong Buy consensus rating based on 30 Buy and five Hold recommendations. Analysts’ average 12-month price target of $149.91 implies 16.5% upside potential from current levels.

Is Meta Platforms a Good Stock to Buy?

Meta is benefitting from the reacceleration in ad revenues, higher engagement, and its investments in AI that are driving efficiency. The stock has gained about 145% year-to-date. Despite the considerable increase in its share price, analysts remain upbeat and expect further upside in its stock.

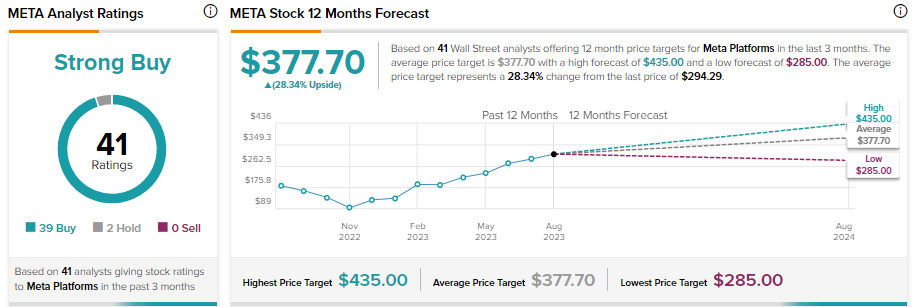

With 39 Buy and two Hold recommendations, Meta Platforms stock commands a Strong Buy consensus rating. Analysts’ average 12-month price target of $377.70 suggests a 28.3% upside potential from current levels.