Meta Platforms’ (NASDAQ:META) popular photo and video service app, Instagram, drives a surge in its revenues. The app made up 30% and contributed $16.5 billion to the company’s total revenues in the first half of 2022, according to court filings accessed by Bloomberg.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Furthermore, the court documents revealed that Instagram’s revenues accounted for 27% of Meta’s business, generating $32.4 billion in 2021. This app also contributed $22 billion to revenues in 2020, representing 26% of Meta’s total sales.

Meta is currently in a standoff with the U.S. Federal Trade Commission (FTC) after unilaterally changing a consent agreement related to privacy violations concerning Meta’s subsidiary, Facebook. Compounding the issues for the social media giant, a U.S. court has recently granted the FTC permission to investigate Meta Platforms for privacy breaches.

Analyst Remains Upbeat on Instagram’s Prospects

After this development, even top-rated TD Cowen analyst John Blackledge, known for his 56% success rate, expresses optimism regarding Instagram’s potential. Furthermore, the analyst’s Q1 FY24 survey data reveals a growth in Instagram engagement among users.

Consequently, Blackledge has increased his revenue projections for Q1 and for the period spanning FY24 to FY29 by an annual range of 1% to 4%. Additionally, he reaffirmed a Buy rating on META stock and revised his price target upward from $500 to $590. This new price target reflects a 14.9% upside potential from current levels.

Is META a Buy or Sell?

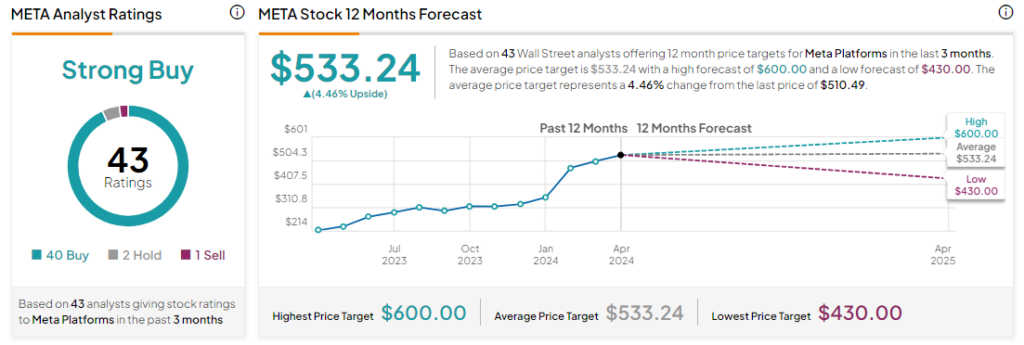

Analysts remain bullish about META stock, with a Strong Buy consensus rating based on 40 Buys, two Holds, and one Sell. Over the past year, META has skyrocketed by more than 100%, and the average META price target of $533.24 implies an upside potential of 4.5% at current levels.